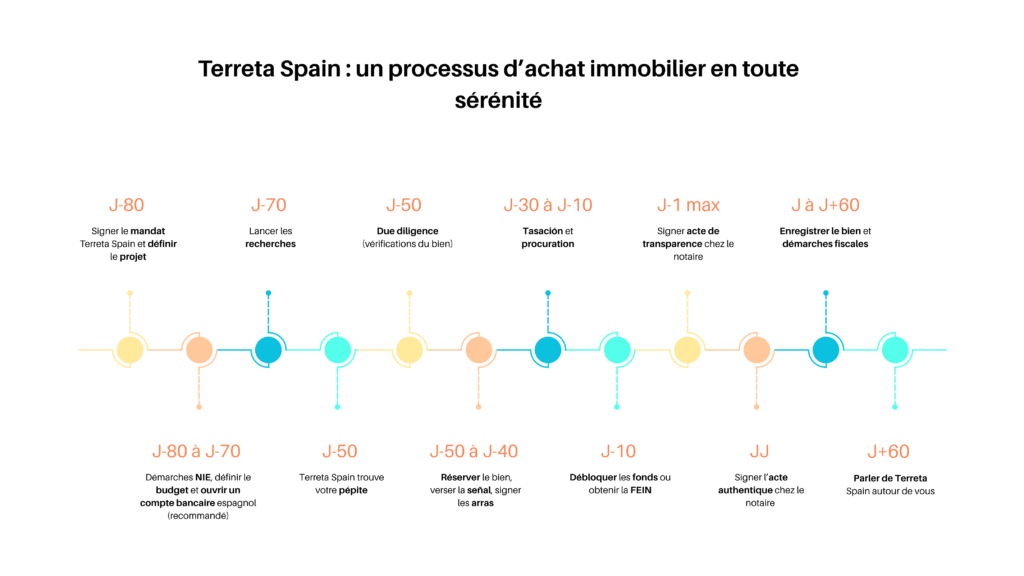

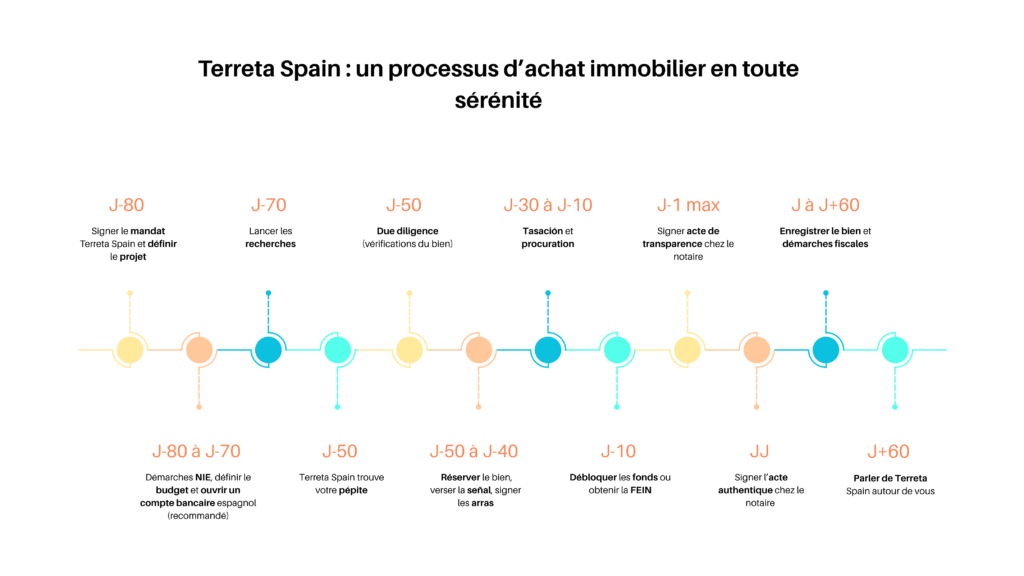

Investing in Spain is not just about signing a deed at the notary. It's a structured process, with key steps and deadlines to be aware of in order to be well prepared and avoid unpleasant surprises.

Do you have a project? Here is the ideal, realistic and calibrated retro-planning for international investors.

D – 80: Signing of the Terreta mandate and definition of your project

It all starts with a clear vision. To be effective, you need to precisely define your investment project. To do this, the experienced Terreta team guides you step by step to define the project according to your budget, your objective, your preferences and your criteria.

At this stage, you must decide:

- Where you want to buy: the location (Valencia, Malaga, Madrid, Gandia or elsewhere?)

- What you want to buy: the type of property you are looking for, i.e. a second home, a tourist rental, a traditional rental investment?

- How much you want to spend: your overall budget, including between 13% and 15% of fees (purchase taxes, agency or support fees, notary).

- Your financing method: from your own funds or a bank loan.

This is also a good time to consult a tax expert or validate a loan if you are partially financing your purchase.

- In Spain, foreign residents can claim 60-70% of the property value.

- You can borrow in your country of origin. You will surely be asked to mortgage a property and you will have to pay fees to repatriate the funds.

Estimated time: 1 to 2 weeks

Don't know where to buy in Spain? Discover the opinion of our experts.

D – 75 to D – 60: Obtain your NIE and open a bank account

The Foreigner Identification Number.

Without it, it is impossible to sign anything. The NIE is your key to Spain. This is an official number that allows you to track all transactions in the country. To go further on this point, read our practical guide.

The NIE can be obtained:

- Directly in Spain, via a police station.

- From abroad, via the Spanish consulate.

Allow €10/12 in fees.

Opening a Spanish bank account

Opening an account in Spain is essential to:

- Apply for a loan on site.

- Pay taxes and notary fees, and simplify taxation in general.

- Facilitate all local transactions, such as current expenses (water, electricity, co-ownership association).

Traditional banks (BBVA, Santander, Sabadell) can be picky, but everything is feasible in 1 to 2 weeks with a complete file (identity document, NIE, proof of address, proof of income, certificate of non-residence for foreigners).

Online neobanks (N26, Revolut, etc.) offer shorter deadlines of 24 to 48 hours for a digital opening, but it will be difficult to have in-depth contact with customer service and your management possibilities will be limited.

Allow 1 to 4 weeks, sometimes a little more depending on the location and administrative delays, to carry out these two actions in parallel.

D – 60 to D – 30 : Start the search

This is where things accelerate if you are well supported. Alone, they can become complicated.

- Visit (physically or remotely) the properties that match your project.

- Compare properties, prices, neighborhoods, access to local infrastructure.

- Negotiate the price. Spanish sellers are aware that local real estate appeals to foreigners and may push their luck.

At Terreta Spain, we take care of everything for you. Contact us to launch your project.

It is common to find a property in 2 to 4 weeks, especially if the specifications are precise.

D – 30 to D – 10 : Verifications, reservation, tasación and power of attorney

At this stage, several actions must be carried out in parallel.

D-30 to D-20: Due diligence

A very important point to secure your purchase!

In Spain, the notary is not responsible for verifying whether the property conforms to its description or whether it complies with the law. This is YOUR responsibility, the buyer's responsibility.

What to check?

- The certificate of occupancy.

- The land registry.

- Local urban planning regulations (extensions, major renovations, etc.)

- The absence of ongoing disputes and debts of the current owner by verifying the Nota Simple and requesting a certificate from the co-ownership association.

Allow 2 to 3 weeks, depending on the complexity of the property.

D-20 to D-10: The tasación

If you apply for a loan, the bank will ask you for a tasación : an official valuation of the property price.

- This inspection is responsible for verifying that the property's value aligns with the market.

- And that its value covers the amount of the loan granted, in the event of default.

- It is not useful to request a tasación before the legal checks. This saves you unnecessary expenses for non-compliant properties.

Generally, the bank is responsible for appointing an expert, but this can take time. You can save up to 3 weeks by sending a tasador approved by the Bank of Spain yourself (300€ on average, can go up to 600€) or by purchasing the owner's if it is still valid (it must be less than 6 months old).

Once all the checks are completed — due diligence and tasación included, ideally before D–15 — you can legally reserve the property.

D-20: Power of attorney request

If you cannot or do not want to be present at the signing of the public deed, consider making a notarized power of attorney for your agent or lawyer around D–20.

This power of attorney can be executed from Spain or your country of residence (with apostille or via the Spanish consulate).

Make sure that the notary or your real estate expert on site has the original document in time, especially if you had it done abroad with an apostille.

Allow approximately 10 business days to finalize this document. It must be ready no later than one week before the scheduled signing.

D–15 and D–10: Reserve the property, pay the señal and sign the arras

Is everything ok? Has the property been checked? Is the price negotiated based on the results of the due diligence? Then, it's time to legally reserve it.

- You pay between 3% and 10% of the price to block the sale. This is called the señal. More information is available in our practical guide.

- You sign the contrato de arras. A pre-contract that defines the period within which the sale must take place (generally, between 1 and 2 months after this signature).

To learn more about the specifics of this contract and the risks in the event of non-compliance, visit our practical guide.

Our advice: sign the arras before a notary and include a suspensive clause linked to the result of the checks undertaken or the non-obtaining of the loan, if you are using financing.

Allow 15 days to 3 weeks.

D – 10: Release the funds and obtain the FEIN

Two things to know here to finalize the financial aspect of your investment:

- Allow 48 hours for the release of funds, up to a week for an international transfer.

- Ask your bank for the FEIN. This is the Ficha Europea de Información Normalizada, insert link to practical guide a mandatory document in Europe. It contains all the information of the loan that has been granted to you (amount, rate, duration, etc.).

This process is quick: 48 hours to 1 week is enough once the requests have been launched.

Day D: Signing of the notarial deed, the Escritura

The big day has arrived: you sign the escritura before a notary, you pay the balance, and above all… you finally receive the keys.

Everything happens in a few hours. You can physically attend the meeting or not, if you have requested a power of attorney.

Day 0 to Day + 60: Registration, taxation, and services

After signing, some tasks remain.

- The deed is registered in the Land Registry (Registro de la Propiedad), which generally takes about fifteen days.

- Taxes are settled (ITP, AJD, or VAT as applicable) within 30 days of purchase.

- Water/electricity/gas subscriptions are transferred to your name.

- Registration with the Cadastre is completed in about ten days.

This phase lasts between 1 and 2 months, and actions are carried out in parallel, but you are already the owner.

Total estimated duration: less than 4 months if the process is smooth.

Longer if you:

- Handle the procedures from abroad or purchase alone.

- Purchase a property with legal specificities.