Do you own an apartment in Valencia, a beachfront house in Alicante, or a property in Madrid, and are you considering selling? Whether you are a tax resident in France or elsewhere, selling real estate in Spain is subject to specific rules: 3% withholding tax for non-residents, mandatory documents in Spanish, coordination with a Spanish notary, management of local capital gains, etc.

The good news? With the right approach and tailored support in your language (French, English, Spanish), selling in Spain can be smooth, fast, and profitable. This guide explains everything: from valuation to signing at the notary's office, including taxation and common mistakes to avoid.

"Selling your property in Spain: the complete guide from Terreta Spain" – let's get started.

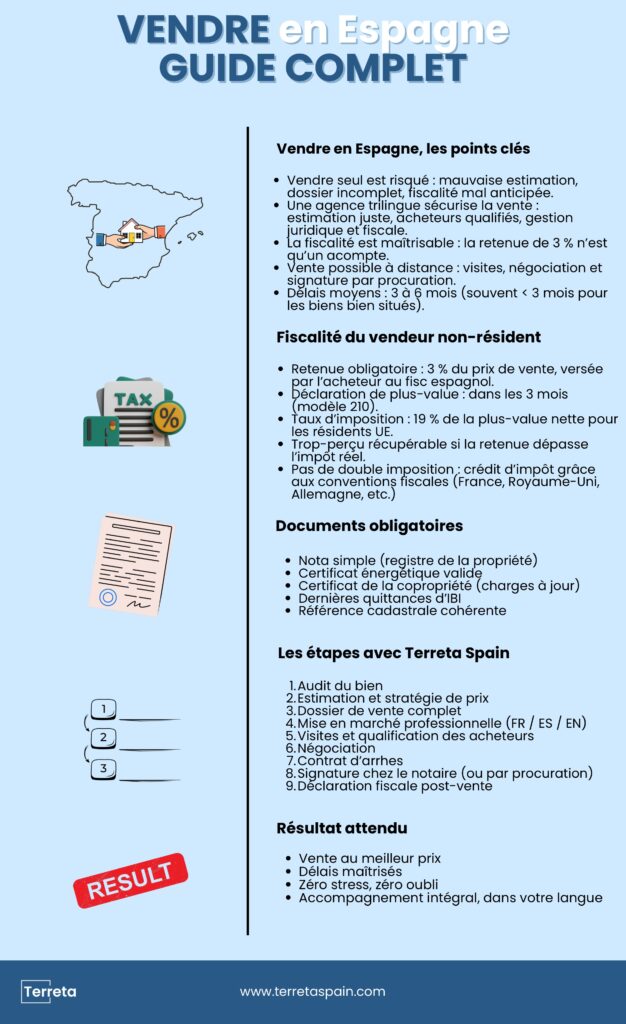

| In short: Selling your property in Spain, what you need to remember Selling on your own is risky: approximate valuation, incomplete documentation, poorly managed taxation, unbalanced negotiation. A multilingual agency such as Terreta Spain secures and speeds up the sale: realistic valuation, complete documentation, professional marketing, buyer qualification, tax support. In French, English, and Spanish. The choice is yours. Taxation is not an obstacle: with the right support, the 3% withholding tax and capital gains tax declaration are handled without stress. You can sell remotely: viewings, negotiations, and signing by proxy—everything is possible from France, the Netherlands, Great Britain, or anywhere else in the world. Average sale time: 3 to 6 months, often less than 3 months for properties in good locations in Valencia or Madrid. Do you have a project to sell in Spain? Terreta Spain supports you from A to Z, in your language, with a single goal: to sell at the best price, without stress. Estimate my property button |

Selling on your own or with a French-speaking agency: the real calculation

The temptation to sell alone

Many French and foreign property owners ask themselves: "Why pay agency fees when I can sell my property myself?"

On paper, the idea may seem appealing. You save 3 to 5% of the sale price. But in reality, selling on your own in Spain when you don't have a perfect command of the language, the local market, the codes, and legal procedures is a significant risk.

The concrete risks of selling on your own:

- Rough estimate: without detailed knowledge of the market, you risk overestimating (and never selling) or underestimating (and losing thousands of euros).

- Incomplete or non-compliant file: expired energy certificate, outdated simple note, missing community certificate, etc. A serious buyer (or their bank) may back out at the last minute if the file is not in order.

- Poor tax management: the 3% withholding tax, capital gains tax returns (IRNR), three-month filing deadlines... An oversight or mistake can cost you much more than agency fees.

- Unbalanced negotiation: when dealing with a well-advised buyer (with an agent, lawyer, tax advisor), you are at a disadvantage if you negotiate alone without local expertise.

- Wasted time and stress: organizing visits from your country of residence, answering questions in Spanish, dealing with reminders, coordinating with the notary and buyer... It's a full-time job. Ours.

What a trilingual agency (French, English, Spanish) can offer you in concrete terms

A specialized agency such as Terreta Spain does not just post an ad online. It secures your transaction from start to finish:

- Realistic and defensible estimate, based on a detailed comparative market analysis (price per square meter, rental or purchase demand, direct competition, neighborhood trends).

- Preparation of a complete and compliant sales file: up-to-date simple note, valid energy certificate, certificate from the homeowners' association confirming no outstanding debts, latest IBI receipts, consistent cadastral reference.

- Professional marketing: HD photos, virtual tours, multilingual adverts (French, Spanish, English), listing on Spanish portals (Idealista, Fotocasa) and distribution to our network of qualified and highly responsive international buyers.

- Qualification of buyers: credit checks, screening of visits, organization of physical or video visits depending on the situation.

- Comprehensive tax support: coordination with partner tax attorneys for capital gains tax returns, recovery of the 3% withholding tax if necessary, post-sale tax optimization.

- Easy remote sales: if you live in France, the agency manages viewings and negotiations and can finalize the sale by notarized proxy. You don't need to travel.

- The result: a faster sale (3 to 6 months on average), at the best price, without stress or unpleasant surprises.

Taxation of real estate sales in Spain for non-residents

This is often the point that worries foreign sellers the most: "How much tax will I pay in Spain? And in my country?"

The 3% withholding tax: what is it and how does it work?

If you are not a tax resident in Spain (i.e., you are a tax resident in France or elsewhere), the buyer is legally required to withhold 3% of the sale price and pay it to the Spanish tax authorities when signing at the notary's office.

Concrete example:

You sell an apartment for €200,000. The buyer retains €6,000 (3%) and pays you €194,000. The €6,000 is paid to the Spanish Treasury as a down payment on your capital gains tax via the modelo 211 form.

This withholding tax is not the final tax. It is a guarantee for the Spanish tax authorities. You must then declare your actual capital gain within three months of the sale.

Capital gains tax return (IRNR)

Within 90 days of signing, you must complete Form 210 to declare your capital gains on real estate in Spain.

How is capital gain calculated?

Capital gain = Sale price − (Purchase price + acquisition costs + justified renovation costs + selling costs)

What is the tax rate?

19% of the capital gain for non-residents whose tax domicile is in Europe.

Example:

- Purchase price: €150,000 (+ €15,000 in purchase fees)

- Selling price: €200,000 (− €8,000 in selling costs)

- Net capital gain: $200,000 − ($150,000 + $15,000) − $8,000 = $27,000

- Tax due: 27,000 × 19% = $5,130

- Since the buyer retained €6,000 and you actually owe only €5,130, you can claim €870 back from the Spanish tax authorities.

- Conversely, if your actual capital gain generates a tax liability of more than €6,000, you will have to pay the difference.

What about taxation in your country of residence?

If you are a tax resident in France, for example, you will also have to declare your capital gains in France. But there is good news: thanks to the Franco-Spanish tax treaty, the tax paid in Spain is deductible from French tax (tax credit mechanism).

The same applies to all countries that have signed similar agreements, and there are many of them: Germany, Belgium, Denmark, Finland, the United States, the United Kingdom, etc.

You therefore do not pay twice, but you must declare your income in both countries.

Terreta Spain's advice: we put you in touch with our partner tax lawyers, such as Felix Delaguía Luzón, to handle this entire process. You don't have to worry about a thing; we make sure that everything is declared correctly and on time.

Required documents for selling property in Spain

In Spain, the seller is required to provide several documents before signing. An incomplete file can block the sale or scare off the buyer.

The simple note (extract from the Property Registry)

It is a kind of "identity card" for the property, issued by the Registro de la Propiedad(Property Registry). It proves that you are the owner, indicates whether the house or apartment is free of encumbrances (mortgage, foreclosure, easements) and officially describes the property (surface area, cadastral reference, etc.).

Cost: less than €10

When to request it? Just before the sale to ensure that the information is up to date.

The energy certificate (Certificado de Eficiencia Energética)

The EPC is now mandatory for all property sales in Spain. It indicates the energy performance of the property (from A to G) and must be carried out by a certified technician.

Cost: €1.50 per m²

Validity: 10 years (5 years for category G)

The certificate of the homeowners' association

If your property is part of a condominium, you must provide a certificate attesting that you are up to date with your charges and that there are no outstanding debts.

Why is this important? If you have outstanding debts, the buyer may refuse to purchase the property or demand that you settle them before signing. In Spain, debts can be transferred from one owner to another. They are attached to the property and not to the individual or legal entity that owns it.

The latest IBI (Property Tax) receipts

The IBI is the Spanish equivalent of property tax in France. As with condominium fees, you must prove that you are up to date with your payments at the time of sale.

The cadastral reference

This is the unique identification number of your property in the Spanish land registry. It must be consistent with the description of the property in the nota simple.

Terreta Spain's role: we gather all these documents for you, verify their validity, and present them clearly to the buyer. Zero stress, zero oversights.

The steps involved in selling property in Spain with Terreta Spain

We have touched on this briefly, but here is a clear explanation of how your property sale in Spain will work in practice with your Terreta Spain expert:

1. Initial contact and property audit

We start with a discussion to understand your project: why you are selling, your timeframe, and your expectations in terms of price.

We then audit the property: general condition, any work that may be required, strengths to be highlighted, documents already in your possession.

2. Estimation and pricing strategy

Your Terreta Spain expert analyzes the local market (price per square meter, comparable properties, supply/demand) and together we set a realistic and competitive selling price. Neither too high (the property will linger on the market) nor too low (you will lose money). We find the "sweet spot," as they say.

3. Preparing the property (optional)

If necessary, we can advise you on minor repairs or home staging to make the property more attractive. At Terreta Spain, we even offer a turnkey renovation if you want to boost the value before selling. Spoiler alert: it can go up to +30%.

4. Compiling the sales file

We gather all the required documents (simple note, energy certificate, community certificate, IBI, etc.) and check that everything is in order.

5. Placing on the market

Professional photos, virtual tours, multilingual adverts (FR/ES/EN), distribution on Idealista, Fotocasa, our social networks and, as a priority, to our database of qualified (and very active) buyers.

6. Organization of visits and qualification of buyers

We filter applications, check candidates' creditworthiness, and organize visits (in person or via video).

Do you live in France or elsewhere? No problem, we manage on-site visits and provide you with detailed reports.

7. Negotiation

A serious buyer has come forward? Great. We negotiate on your behalf: price, terms, deadlines, coverage of costs, etc.

8. Signing of the deposit agreement (earnest money)

Once an agreement has been reached, the deposit contract is drawn up in Spanish (with a French translation). The buyer generally pays 10% of the price as a deposit.

This contract is binding on both parties: if the buyer withdraws, they forfeit their deposit; if you withdraw, you must return double the amount.

Go further with our practical guide: "The deposit agreement in Spain."

9. Coordination with the notary

The date for signing the authentic deed at the Spanish notary's office is set. We ensure that all documents are ready, that the mortgage (if any) has been lifted, and that the buyer's funds are available.

10. Signing at the notary's office and payment

On the big day: signing of the deed of sale, payment of the balance (with a 3% withholding if you are a non-resident), handover of the keys.

If you are unable to attend, we will sign a notarized power of attorney so that the sale can proceed without you, in complete security.

Would you like to know how the power of attorney process works? Geoffroy, one of the founders of Terreta, explains it in a practical guide: "How to grant power of attorney at a notary's office in Spain."

11. Post-sale tax declaration

Within three months of signing, our partner tax attorneys will take care of the capital gains tax return (form 210) and any refund of overpaid tax.

Average time to sell: 3 to 6 months depending on location, condition, and price. Properties in good locations in Valencia or Madrid often sell in less than 3 months.

Common mistakes to avoid when selling in Spain

Mistake #1: Overestimating the selling price

This is the primary cause of failure. A property that is too expensive remains on the market for months, becomes "suspicious" in the eyes of buyers, and ultimately you have to drastically lower the price.

- The solution: make a realistic estimate from the outset, based on recent comparables and current market conditions.

Mistake #2: Neglecting the presentation of the property

Blurry photos taken with a smartphone, sloppy descriptions, poorly organized or uncleaned for viewings... The result: buyers move on before even visiting.

- The solution: invest in professional photos, write a detailed description, and do some basic home staging (tidy up, depersonalize, air out). Terreta bonus: we can take care of this for you too, click here.

Mistake #3: Not checking the file beforehand

On the day of signing, you discover that your energy certificate has expired, that the community is claiming €2,000 in unpaid bills, or that the simple note mentions an outstanding mortgage. The buyer backs out, and the sale falls through.

- The solution: compile the complete file before putting the property up for sale. Terreta Spain will take care of this for you.

Mistake #4: Forgetting about taxes

Many sellers discover the 3% withholding tax and the obligation to declare capital gains... on the day of signing. Too late to optimize or anticipate.

- The solution: seek assistance from a tax specialist from the outset to calculate the expected capital gain, anticipate costs, and optimize your tax return.

Mistake #5: Accepting an unqualified buyer

You sign a deposit agreement with a buyer who has no down payment, no approved credit, and no financing guarantee. Two months later, they back out, you waste your time, and you have to put the property back on the market.

- The solution: always check the buyer's creditworthiness before signing the deposit. Terreta Spain filters and qualifies all candidates.

Case study: selling an apartment in Valencia

The context

Marie and Julien, a French couple residing in France for tax purposes, purchased an 80 m² apartment in the Ruzafa neighborhood of Valencia in 2018 for €180,000 (including purchase costs: €15,000).

In 2025, they decide to sell in order to reinvest elsewhere. They contact Terreta Spain.

Support from Terreta Spain

- Estimate: after analyzing the local market, the sale price is set at €240,000.

- Preparation: we recommend some minor painting and refurbishment work (cost: €2,000) to enhance the value of the property.

- File contents: simple note, energy certificate, community certificate, up-to-date property tax (IBI).

- Marketing: HD photos, virtual tour, ads in French/Spanish/English, listing on Idealista, Fotocasa, and our network.

- Visits: 12 visits in 3 days, 3 serious offers.

- Negotiation: we negotiate with the best buyer and accept an offer of €238,000.

- Signing of the deposit: the buyer pays €23,800 (10%) as a down payment.

- Signing at the notary's office: 2 months later, signing of the authentic deed. 3% withholding tax (€7,140) paid to the Spanish tax authorities.

- Tax return: our tax lawyer calculates the actual capital gain:

- Selling price: €238,000

- Purchase price: €180,000 + €15,000 (fees) = €195,000

- Work: €2,000

- Selling costs: €7,140 (agency fees 3% excluding tax) + €1,500 (other costs)

- Net capital gain: 238,000 − 195,000 − 2,000 − 8,640 = €32,360

- Tax due: 32,360 × 19% = $6,148

As €7,140 was withheld, Marie and Julien will receive €992 back from the Spanish tax authorities.

Final result: sold in 3 months, optimal price, optimized taxation, zero stress.

They sold with Terreta Spain

"I sold two apartments, one with a Spanish agency and the other with Terreta Spain. The difference is clear: their customer service is methodical and transparent. That's everything a customer needs to feel secure about their transaction. They make reselling simple and post-purchase tax matters easy with their partner lawyers. You can trust them completely."

— Romain Aldeghi

"My wife and I don't speak Spanish very well, so selling with Terreta Spain was very reassuring for us. Maxime handled everything from A to Z with great professionalism, including a problem with the buyer on the day of the sale. As a result, we gave Terreta power of attorney and they signed on our behalf."

— Eric Bernardini

Are you ready to sell?

FAQ: Selling your property in Spain

How long does it take to sell a property in Spain?

On average, 3 to 6 months depending on the location, condition of the property, and price. Properties in good locations in Valencia or Madrid often sell in less than 3 months with professional assistance.

What documents are required to sell property in Spain?

Simple note (extract from the Property Registry), valid energy certificate, up-to-date certificate from the homeowners' association, latest IBI receipts, cadastral reference. Terreta Spain will compile the file for you.

What are the tax implications for a non-resident seller?

The buyer withholds 3% of the sale price for the Spanish tax authorities. You must then declare your capital gains (IRNR) within three months and pay 19% tax on the net capital gains. If the 3% withholding exceeds the tax due, you will be refunded the excess amount.

Can you sell your property remotely from France, the Netherlands, or elsewhere in the world?

Yes, absolutely. Terreta Spain organizes on-site visits, handles negotiations, and can finalize the signing by notarized power of attorney. You don't need to travel.

How much are the agency fees?

Terreta Spain's commission for selling your property is 3% excluding tax of the net sale price. Everything is transparent, with no hidden fees.

What happens if my property does not sell?

We adjust our strategy: price review, improved presentation, wider distribution, promotional work. The goal is always to sell, not to let things sit around.

Do you have to pay taxes in your country of residence as well?

Yes, if you are a tax resident outside Spain, you must declare the capital gain. However, thanks to tax treaties signed with Spain by many countries, the tax paid in Spain is deductible. You declare it, but you don't pay twice.