The Valencia real estate market has become one of the most dynamic in Spain and Europe. Demand continues unabated, the attractiveness of the living environment remains undiminished, and the profile of buyers is becoming increasingly international.

In 2025, the city saw a further jump in prices(€3,227/m², +19.2%, Idealista), but behind this overall rise, there are still opportunities: beyond the historic center, the beach and areas that attract expats, such as Ruzafa, certain neighborhoods remain very affordable and promise good returns and good potential for capital gains.

Valencia's cheapest districts and neighborhoods", Terreta Spain's experts get out the scanner.

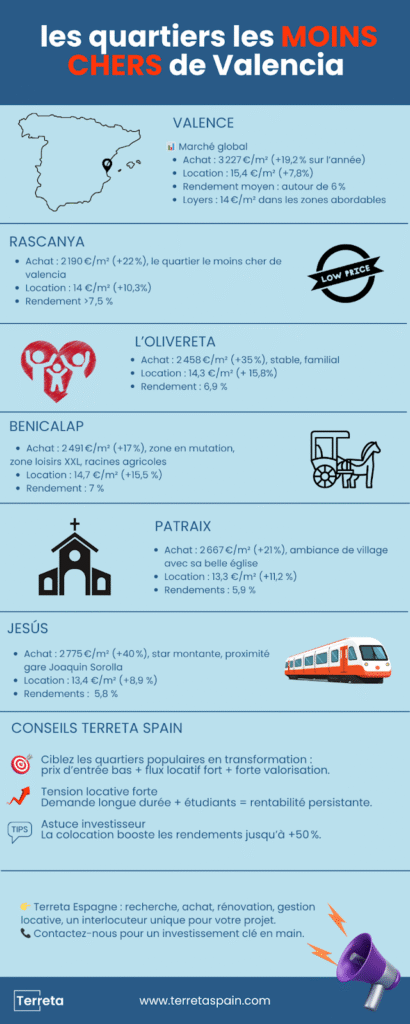

| In brief - You're in a hurry but you want to understand? Valencia: changing market, ultra-dynamic, prices on the rise: €3,227/m² to buy (+19.2% year-on-year) and €15.4/m² to rent (+7.8%, Idealista). Average yield: 5.7%.neighborhoods with opportunities from €2,200/m² in more popular areas. Rascanya, L'Olivereta, Benicalap, Patraix, Jesús. High rental pressure throughout the city, including these areas now. Rental prices: €14/m² on average for these districts. 6-8% gross yield , higher for shared accommodation.Potential for appreciation: annual price growth of up to +40% for Jesús and +52% for Fontsanta (L'Olivereta). Terreta Spain tip: investing in "popular" districts undergoing transformation combines low entry price + high yield + good prospects for appreciation. |

Overview and general trends in the Valencia market

To understand this, let's first take a look at the major trends in the Valencian market in 2025.

- Average prices in Valencia: €3,227/m² for all neighborhoods (Idealista) and €15.4/m² for rentals.

- Annual growth in September 2025: +19.2% for purchases and +7.8% for rentals.

- Premium districts (Ciutat Vella, Pla del Real, Eixample including Ruzafa): over €4,500/m² and €18-19/m2 to rent. Some prestige properties are close to or exceed €6,000/m².

- Rental tension: explosive rental demand for long-term rentals and student rentals. Slowdown in the tourist segment due to new legislation; increased pressure on rents, with growth outstripping inflation (around 3% since January).

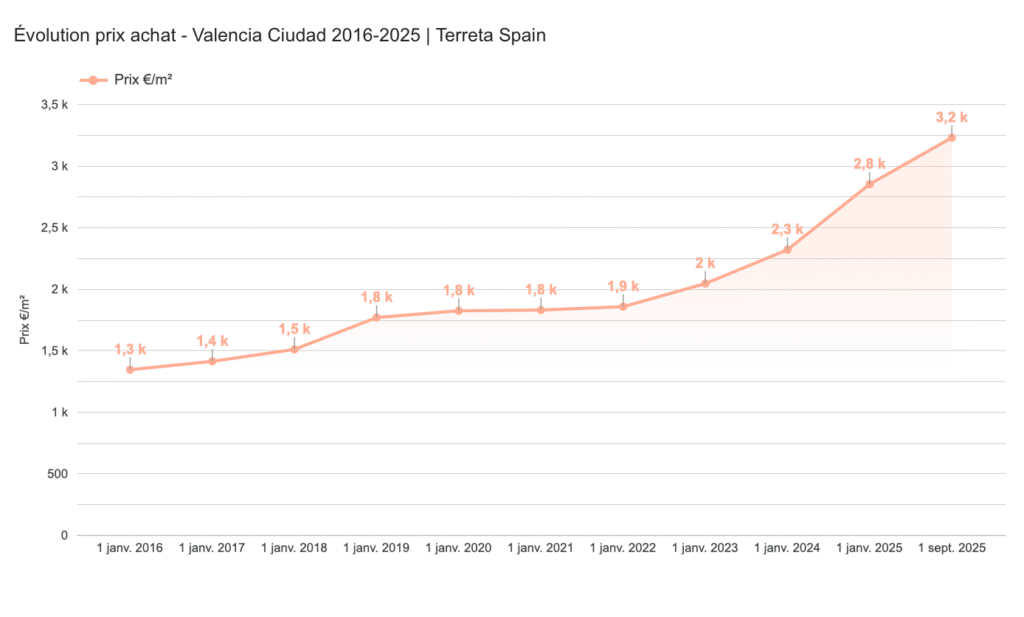

Purchase price trend, Valencia capital, January 2016 - September 2025

Idealista data, Terreta Spain chart

Valencia's top 5 cheapest neighborhoods

Move around our interactive map to find the cheapest areas in the country's third-largest city.

Investing in Rascanya, Valencia's cheapest district

Rascanya is located to the northeast of the city. Traditionally a popular area, it is now very heterogeneous. There are old buildings still "in their juice", more standardized constructions from the 60s and a few modern residences with community swimming pools, notably in the Sant Llorenç area.

When it comes to services, Rascanya lacks nothing: markets, supermarkets, an ultra-modern shopping center (Arena), gyms, schools, transport and more.

- Average price: €2,190/m² (+22.3% over 1 year),

- Quartier Orriols at €1,963/m² (+38.7%).

- Quartier Torrefiel at €2,304/m² (+17%).

- Rental prices: average rents of €14/m² (+10.3%).

- Gross rental yield: 7.6%.

- Benefits for investors :

- Ultra-affordable ticket to Valencia.

- Strong growth prospects with the influx of young professionals, students and immigrants.

- Historical trend: +22.3% annualized, an all-time high. This district shows that the surge in demand is also affecting areas previously shunned by investors.

Terreta Spain's advice: Orriols is in a more fragile social context. To compensate, we focus on quality properties and renovations to target the best tenant profiles. Entrust rental management to professionals to avoid problems.

That's just as well, because construction and management are also part of our business. Just contact us.

Monastery of San Miguel de los Reyes, Rascanya

Wikimedia, Creative Commons

Investing in Olivereta

L'Olivereta is a district to the west of the city. It's well served and close to the Parc de l'Oeste and its swimming pool, a good point. The atmosphere is tranquil and the residents lack nothing. The Nou Moles district is very close to the Túria gardens, a strong argument for families, sports enthusiasts and nature lovers.

- Average price: €2,458/m² (+35.4% annualized).

- Quartier La Fontsanta at €2,011/m²(+52.7%).

- Quartier Tres Forques at €2,333/m² (+45%).

- Quartier Nou Moles at €2,680/m² (+25.3%)

- Rental prices: average rents of €14.3/m² (+15.8%).

- Profitability: 6.9%.

- Investor benefits :

- Highly sought-after area for families.

- Ideal for first-time buyers.

- Stable profitability on long-term leasing, low risk.

Terreta Spain tip: L'Olivereta is the perfect area to start building your assets and for "buy & hold" portfolios. Security and yield.

Olivereta at Fallas, 2025

Wikimedia, Creative Commons

Buying in Benicalap, Valencia's third-cheapest neighbourhood

Benicalap is a popular neighborhood with agricultural roots, located in the north of the city, close to Rascanya and the Nuevo Centro shopping center. It has undergone profound changes over the last 10 years and is quite quiet. Benicalap is renowned for its green spaces and XXL municipal swimming pool, which fills up in summer. New, modern constructions contrast with some dilapidated buildings. Curiosity: horse-drawn carts can be seen heading for La Huerta, the town's vegetable garden, just a few minutes away.

- Average price: €2,491/m²(+17.4% annualized).

- Rental price: €14.7/m² today (+15.5% over the year).

- Profitability: 7% on average.

- Investor benefits :

- The district is undergoing a transformation thanks to the renovation of former wastelands(Grow Green project), the extension of Benicalap park, the construction of Valencia CF's new stadium (Nou Mestalla), which has just started up again, andthe planned construction of hotels and offices in the area.

- Rents have doubled in 5-6 years.

Terreta Spain's tip: Benicalap is also known for its climate of insecurity and its streets, which are less well-maintained than elsewhere. The projection should be made over 3-5 years, the time needed to get things moving.

Benicalap Park

Wikimedia, Creative Commons

Patraix, for a profitable investment in Valencia

Like many locals, our team has a soft spot for Patraix. Located in the south-west of the city, it has a friendly village atmosphere, good transport links and close proximity to the center. It's an inexpensive, flawless neighborhood where you feel right at home, immersed in the gentle Valencian atmosphere.

- Average purchase price: €2,667/m² (+21.2% annualized).

- Rental cost : €13.3/m² (+11.2%).

- Average profitability : 6%. More depending on the type of rental chosen, as always.

- Investor benefits :

- High valuation.

- Great equation: accessibility + yields + authenticity.

Terreta Spain's advice: Go for it.

Patraix Church

Wikimedia, Creative Commons

Jesús, profitability and value

Jesús is located in the southern sector, close to the Joaquín Sorolla (AVE) train station, Central Park and La Rambleta Park. In recent years, neighbors have witnessed massive urban transformations and the arrival of new real estate projects(Crisaldia). The area is residential, with local shops, bars, parks, schools and good transport links. Perfect for young professionals and families. Also perfect for professionals who travel a lot to Madrid.

- Average price: €2,775/m²(+40.7% annualized).

- Quartier L'Hort de Senabre at €2,561/m² (+34.6%).

- Quartier de la Raiosa, more expensive: €3,181/m2 (+37.3%).

- Rental cost: €13.4/m² (+8.9%).

- Gross profitability: less than 5.8%, mainly because square meters are more expensive.

- Investor benefits :

- Rising star" district with record valuation over the past year.

- Strong demand.

- Population mix: young professionals, families looking for more square meters for less, expatriates.

Terreta Spain tip: a 40.7% increase in 1 year is enormous. Only 10 years ago, purchase prices were under 1,000 euros!

Parc de la Rambleta, Jesús district

Wikimedia, Creative Commons

To find out more about all Valencia's neighborhoods, read our complete guide.

Comparison with the rest of the city

Valencia's affordable zones are 30-50% less expensive to buy, but record the strongest annual growth.

Catch-up effect + population influx = driving force behind profitability and valuation.

Why choose the least expensive neighborhoods to invest in Valencia?

- More properties available than in already-valued areas.

- Good gross profitability: purchase prices in the lower end of the Valence market often generate returns in excess of 7%, higher than in premium neighborhoods.

- Growth potential: price rises over 2025 suggest that the upward cycle will continue for some time yet.

- Rental profile: growing local and international demand.

- Gentrification" effect: working-class neighborhoods, which have long been ignored, are seeing the arrival of new projects, shops and facilities, generating a collective revaluation.

Investment strategy in Valencia's least expensive neighborhoods

- House flipping: investing in old buildings to renovate and resell in the process.

- Shared flats: target large apartments for maximum return, especially for student rentals.

- Local support: working with experienced hunters to find nuggets and maximize performance.

Ready to invest in Valencia's least expensive neighborhoods? Contact us to discuss your project.

Conclusion

In 2025, investing in Valencia's least expensive neighborhoods is a winning strategy. Thanks to affordable entry prices, exceptional annual growth and very solid rental demand, you can combine yield, security and asset enhancement. 📞 Shall we call you?

FAQ - Valencia's cheapest neighborhoods

Which are Valencia's cheapest areas in which to invest?

Rascanya, L'Olivereta, Benicalap, Patraix and Jesús still offer attractive purchase prices, from €2,200-2,800/m², while offering strong potential for value enhancement.

What are the possible rental yields?

Gross returns are often in excess of 6%, rising to 7-8% in certain neighborhoods and through shared accommodation.

Is there a risk of rental vacancy in these neighborhoods?

The risk is more pronounced in Rascanya. Choose the right location and type of property, and opt for renovation and professional management.

Why do these neighborhoods attract investors?

They are benefiting from a catch-up effect: still-low prices, rapid growth, the arrival of new families and young professionals, and renovation projects that are boosting demand and valuation.

Which tenant profiles are concerned?

Many students, young professionals and local families, but also growing international demand.