Definition

La renta imputada is a theoretical income imposed by theAgencia Tributariathe Spanish tax authority, on non-resident owners of unlet or occasionally let property in Spain. This income is based on a flat-rate calculation of the property's cadastral value.

Renta imputada was created because, even in the absence of rental income, the State considers that the property generates an economic benefit for its owner.

As a reminder, non-residents are people who spend less than 183 days a year in Spain, and who have neither their economic nor family center of interest there.

Who is affected by renta imputada?

Renta imputada applies to non-resident owners whose property is not rented out or is rented out only occasionally.

How is renta imputada calculated?

What is the renta imputada calculation based on?

The notional income is calculated on the basis of the cadastral value(el valor catastral) of the home.

The cadastral value is indicated on theIBI (local property tax).

Two different percentages can be used in the calculation:

- 1.1% if the cadastral value has been revised in the last 10 years.

- 2% if the cadastral value has not been revised.

What is the tax rate?

The tax rate applied depends on the taxpayer's tax residence.

- 19% for residents of the European Union or the European Economic Area

- 24% for non-EU or EEA residents (and therefore UK residents since Brexit came into effect) link the brexit article once published

Concrete example

Unleased property

- A non-resident British citizen owns an unlet apartment with a cadastral value of €100,000.

- The value has not been revised for over 10 years.

Renta imputada: 100,000 x 2% = €2,000

Tax due = 2,000 x 24% = €480

Occasional rentals

In the case of partial rental, the renta imputada applies only to periods when the property is not rented.

- The tax base (cadastral value x 1.1% or 2%) is prorated to the number of days or months the property is vacant.

- During rental periods, the actual rental income is taxed.

Practical information: when and how to declare renta imputada?

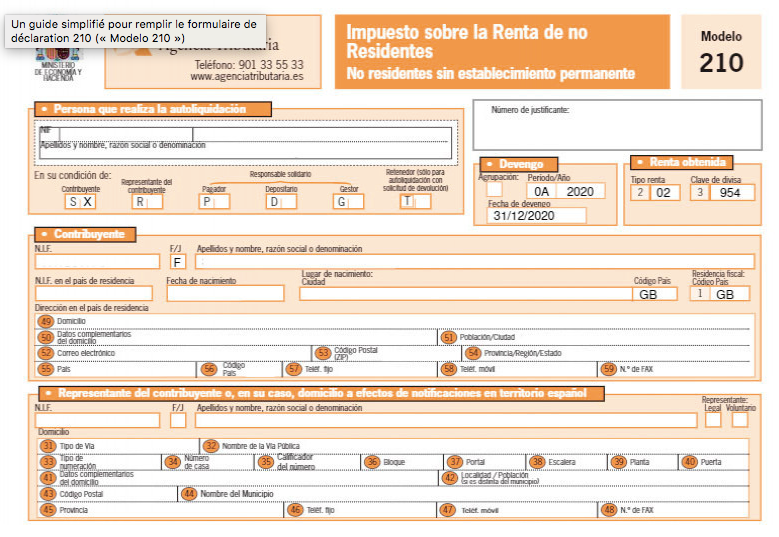

- You will need to useAgencia Tributaria 's modelo 210 to declare your non-resident income (IRNR).

- File your declaration each year before December 31 for the previous year.

- Pay by bank transfer or direct debit.

To remember:

- Renta imputada is due even if the property is not rented.

- In the case of partial rentals, renta imputada is prorated to the number of days the property was not rented.

- No discounts or deductions are allowed.

Sources

Agencia Tributaria