1. Before selling: what you need to know

- Selling on your own in Spain is still possible, but risky: approximate estimates, incomplete documentation, poorly managed taxation, unbalanced negotiations.

- A multilingual agency (French/English/Spanish) such as Terreta Spain secures the sale: realistic price, complete file, professional marketing, buyer qualification, tax support.

- Average time to sell: 3 to 6 months, often less than 3 months for an apartment or house in a good location in Madrid, Valencia, or elsewhere.

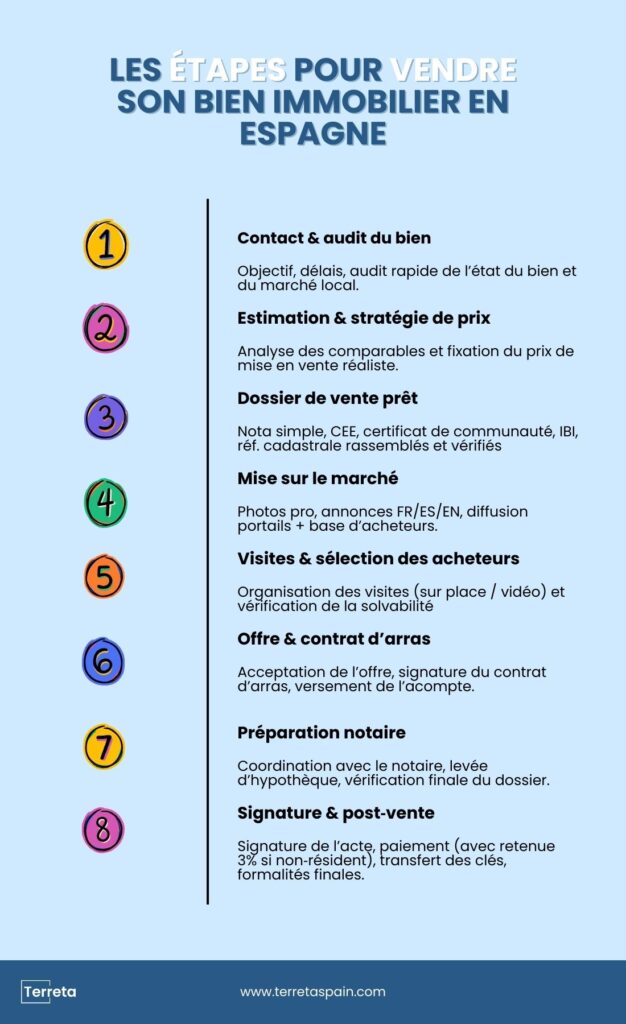

2. The 6 key steps to selling your property in Spain

Step 1 – Audit and estimation

- Analysis of your project ( reason for sale, deadlines, target price).

- Local market analysis: comparable properties, price per square meter, demand, neighborhood characteristics.

- Setting a realistic and defensible asking price to avoid an "overpriced" property that won't sell.

Step 2 – Sales file and mandatory documents

To prepare (or have prepared by Terreta Spain):

- Simple note up to date: owner, charges, mortgages, easements.

- Energy certificate (CEE) required. (form to be inserted once published)

- Community certificate: certifies that condominium fees are up to date.

- IBI receipts (property tax) and consistent cadastral reference.

Terreta Spain verifies the consistency of information (land registry/register, linking the article once published), identifies any issues and corrects them before the property is put up for sale.

Step 3 – Promotion and dissemination

- Professional photos, possibly a virtual tour, clear description in FR/ES/EN.

- Publication on the main Spanish portals (Idealista, Fotocasa, etc.) + Terreta Spain's international buyer database.

- Advice on renovations/home staging if necessary (to increase resale value).

Terreta Spain is the only French-speaking and multilingual real estate agency offering a turnkey renovation service.

Contact us for an estimate of the work your property may need before it goes on the market.

Step 4 – Viewings, qualification, and negotiation

- Sorting applications and verifying buyers' creditworthiness (down payment, financing).

- Organization of on-site or video visits, reports to the seller (useful if you live in France or elsewhere).

- Negotiation of price, deadlines, and conditions (furniture, work, specific clauses).

Step 5 – Preliminary agreement and notary preparation

- Drafting of the deposit agreement (the equivalent of a Spanish preliminary sales agreement): generally a 10% deposit.

- Explanation of consequences:

- if the buyer withdraws, they forfeit the deposit;

- if the seller withdraws, he must return the duplicate.

- Coordination with the notary: schedule, final documents, possible mortgage release.

Step 6 – Signing and after-sales service

- Signing of the authentic deed at the notary's office (or by proxy if you are not present).

- Payment: sale price – 3% tax withholding for non-residents – any mortgage repayments.

- Termination/transfer of contracts (water, electricity, gas), notification to the homeowners' association.

3. Taxation of non-resident sellers: the essentials

3% withholding

- If you are not a tax resident in Spain, the buyer will withhold 3% of the price and pay it to the Spanish Treasury as an advance payment on your capital gains tax.

Capital gains declaration (IRNR)

- Deadline: 3 months after the sale to file the declaration (form 210).

- Rate: 19% of net capital gains for EU residents, 24% of gross capital gainsfor non-EU residents.

- Si l’impôt dû < 3% retenus, vous récupérez la différence ; s’il est >, vous payez le complément.

Taxation in your country of residence

- The capital gain must also be declared in France or in your country, but tax treaties prevent double taxation: the tax paid in Spain is credited against your tax liability.

Terreta Spain works with partner tax lawyers to calculate capital gains, file forms, and recover any overpayments where applicable.

4. Why use a multilingual agency such as Terreta Spain to sell your property in Spain?

Language & teaching: clear explanations in French, English, or Spanish, whether for you or for the buyer.

Legal certainty: verification of documents, coordination with notary, lawyer, tax specialist.

Access to international buyers: a database of French-speaking and foreign customers who are already qualified, which speeds up the sales process.

Remote sales: complete management of the process, with the option of signing by proxy if you are unable to attend in person.

5. The right reflex

If you are preparing for a sale, start by:

- Check your documents (simple note, EEC, charges, IBI).

- Ask for a realistic estimate.

- Clarify the tax implications (3% withholding tax, capital gains, deadlines).

Terreta Spain can handle these three points during an initial discussion, then offer you a clear sales plan with a single goal: to sell quickly, at the right price, without stress.

To learn more, check out our "Complete Guide to Selling Real Estate in Spain."

FAQ – Selling your property in Spain

How long does it take to sell a property in Spain?

On average between 3 and 6 months, depending on the location, condition of the property, and price level. Properties in good locations in Valencia or Madrid often sell in less than 3 months with a realistic pricing strategy and professional marketing.

Can I sell my property remotely from France or another country?

Yes. Viewings, reports, negotiations, and even signing can be handled remotely via a notarized power of attorney. An agency such as Terreta Spain coordinates the notary, buyer, and tax advisor so that the sale can go ahead without you having to travel.

What documents are required to sell property in Spain?

The main ones are: the updated nota simple, the energy certificate, the certificate from the homeowners' association (if applicable), the latest IBI receipts, and the cadastral reference consistent with the Property Registry.

What is the 3% withholding tax for non-residents?

If you are a non-resident for tax purposes in Spain, the buyer must withhold 3% of the sale price and pay it to the Spanish Treasury as an advance payment on your non-resident tax. This is not the final tax, but a guarantee for the tax authorities.

How is capital gains tax calculated in Spain?

The capital gain is the difference between the sale price and the purchase price, including acquisition costs, certain justified works, and selling costs (agency, notary, etc.). IRNR tax is then calculated, generally at 19% for sellers who are EU residents.

Do I have to pay taxes in my country of residence as well?

Yes, the capital gains must be declared in your country of tax residence. However, tax treaties signed with Spain provide for a tax credit mechanism: the tax paid in Spain is deducted from the tax due in your country, thereby avoiding double taxation.

What happens if the 3% withheld is more than the tax actually owed?

After the sale, you file the declaration (form 210). If the tax calculated is less than the 3% withheld, you can request a refund of the difference from the Spanish tax authorities. If it is higher, you only pay the difference.

Is it risky to sell without an agency?

Yes, especially if you are not fluent in Spanish and unfamiliar with the local market and tax system. The main risks include: incorrect pricing, incomplete documentation, poor management of the 3% withholding tax and capital gains tax, and unbalanced negotiations with a well-advised buyer.

What does a multilingual agency like Terreta Spain offer?

She handles the appraisal, paperwork, marketing, buyer qualification, negotiation, and coordination with the notary and tax advisor. All of this is done in French, English, or Spanish, which makes the transaction secure for foreign sellers.

What are the agency fees for the sale?

The fees charged by specialized agencies such as Terreta Spain are generally around 3% excluding tax of the net selling price, with a fee structure announced in advance and no hidden costs.