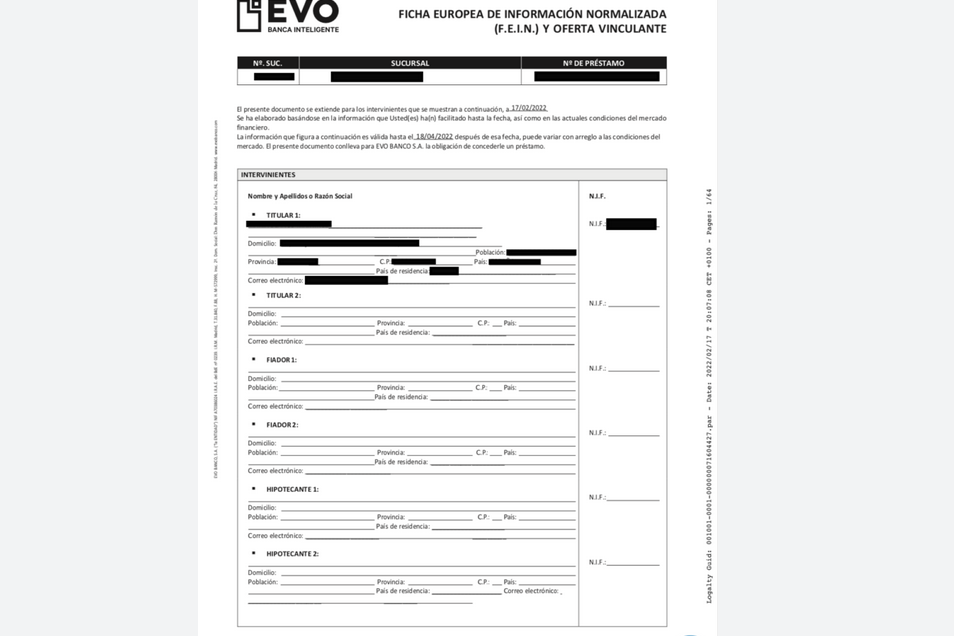

What is the FEIN?

The FEIN is the Ficha Europea de Información Normalizada (European Standardised Information Sheet), a mandatory document that the bank or lender must provide to you before signing your mortgage. It details the agreed loan precisely. The FEIN meets a requirement of the European Credit Directive, which aims to ensure transparency and comparability between different loan offers.

What does the FEIN contain?

This standardised document clearly and comprehensively presents the essential information related to your loan:

- The loan amount

- The interest rate (fixed or variable)

- The loan term

- The monthly payments

- The APR (Annual Percentage Rate, which expresses the overall cost of a loan)

- Additional costs (notary fees, application fees, etc.)

- The consequences of non-payment

- The possibility of early repayment

When do you receive the FEIN?

The bank must give you the FEIN at least 10 days before signing the authentic deed at the notary's office. This period allows you to:

- Read the document in detail

- Compare with other offers

- Ask all your questions before committing