How to declare your rental income in Spain on your French tax return

Every year it's the same thing: the tax declaration period comes around again... and with it, total confusion. We can't remember how we did it last year, and we're still hesitant about which boxes to fill in. If you receive rental income in Spain, here's a step-by-step guide to declaring it correctly on your French return, in accordance with the Franco-Spanish tax treaty.

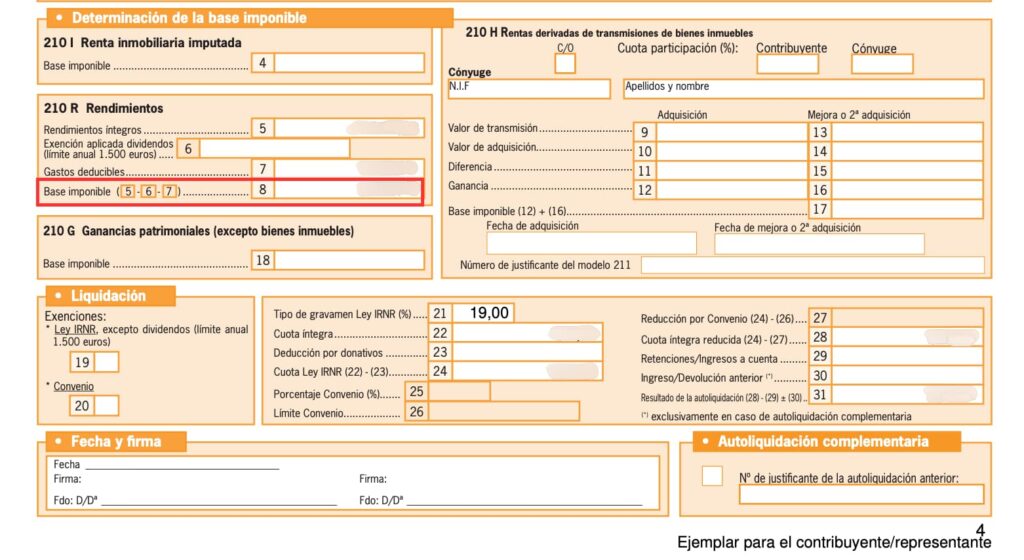

1. Retrieve your Modelo 210

The first step is to retrieve your Spanish tax return, the Modelo 210, which you should have completed with your accountant in Spain. This document details:

- The gross income received from the rental,

- The deductible expenses (management fees, property tax known as IBI in Spain, loan interest, depreciation of the property price, depreciation of works, depreciation of furniture and decoration, etc.),

- And the taxable base, i.e., the amount on which you were actually taxed in Spain.

👉 It is this taxable base (and not the gross income) that you will use for your tax return in France. See the red box below.

Do you own several properties abroad? No problem: simply add up the taxable bases of your properties located in the same country to declare them together.

2. Completing the French declaration

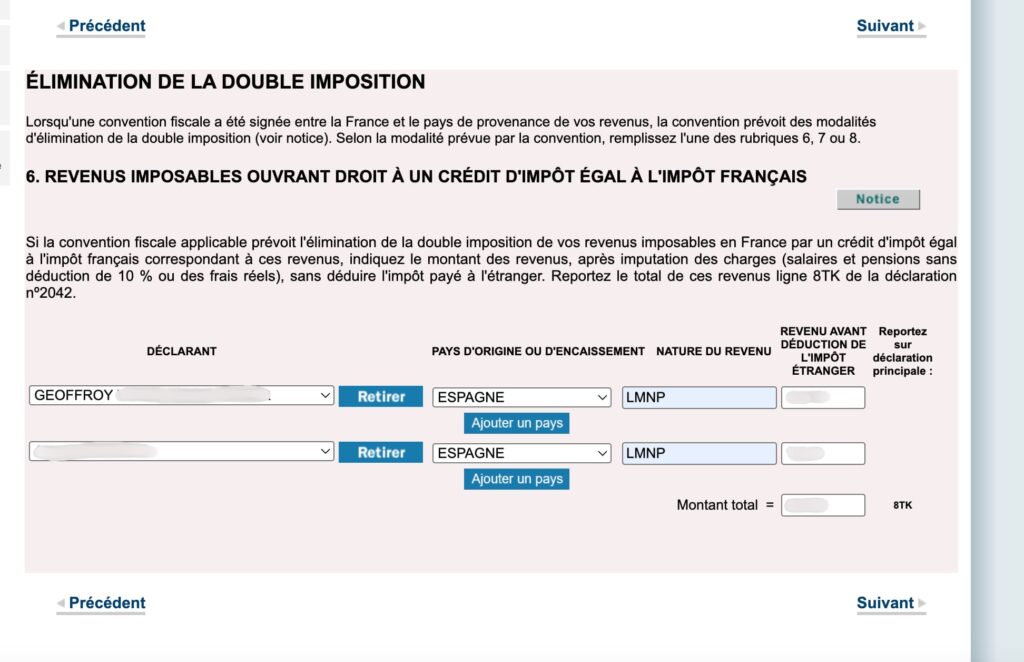

a) Form 2047 – Foreign Source Income

When you declare foreign rental income, it automatically triggers the opening of form 2047, which is used to report income from foreign sources.

On this form:

- You select the country: Spain.

- You indicate the type of income: for example, LMNP if you are a non-professional, or simply "rental income."

- You report the amount of the taxable base indicated on your Modelo 210.

The boxes generally concerned are:

- 5EY or 5FY, depending on the person (you or your spouse).

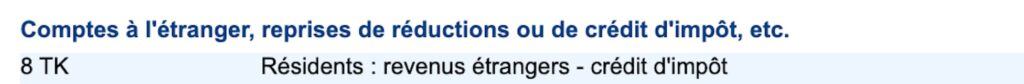

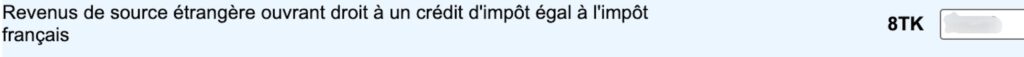

b) Main Form – Box 8TK

In parallel, this declaration automatically fills in box 8TK of your main declaration. This box corresponds to income from foreign sources entitling you to a tax credit equal to the French tax, in accordance with the tax treaty between France and Spain.

3. Final checks

Make sure that the following three boxes are correctly filled in:

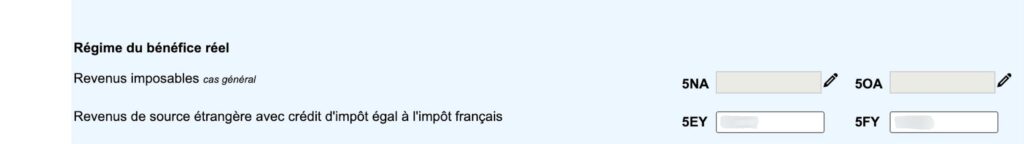

Boxes 5EY and 5FY

- 5EY and 5FY (depending on the person concerned in the couple): these boxes appear in form 2047 and correspond to income from foreign sources with a tax credit equal to the French tax.

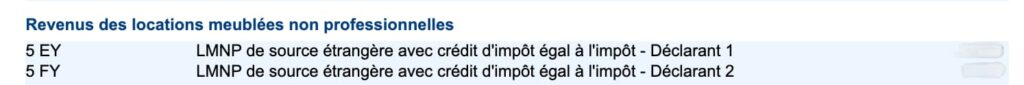

- 👉 They may also appear in the “Non-Professional Furnished Rental Income” section, under the heading “LMNP from foreign sources with a tax credit equal to the French tax”. (See example below)

Income from foreign sources with tax credit equal to French tax – boxes 5EY and 5FY

LMNP from foreign sources with tax credit equal to French tax” – boxes 5EY and 5FY – another view of the same thing

Box 8TK

- 8TK (main form): This box includes foreign income that qualifies for a tax credit equal to the French tax.

- 👉 Unlike boxes 5EY/5FY, 8TK is unique for both filers. (See example below). If, for example, you each had a taxable base of €10,000 on your Modelo 210 declarations in Spain, then in 8TK you can declare the combined amount, i.e. €20,000.

Foreign income – tax credit – box 8TK

Income from foreign sources qualifying for a tax credit equal to the French tax – box 8TK – another view of the same thing

And that's it! This system avoids double taxation: your income is taxed in Spain but neutralized in France thanks to the tax credit mechanism equal to the French tax, as provided for in the Franco-Spanish tax treaty.

4. Don't forget to declare your foreign bank accounts either.

If you receive rental income abroad, it is very likely that you also have bank accounts abroad. Remember to declare them too, for an irreproachable tax declaration!