You are selling your apartment in Valencia, a house in Alicante, or a property in Madrid, and your notary tells you, "Be careful, there is a difference between the Cadastre and the Property Registry." You start to panic, wondering, "Is this serious? Which one is correct? And how do we fix this?"

Spoiler alert: in Spain, these discrepancies are very common, especially with older properties. The good news? They can almost always be corrected. But you need to know how to go about it and, above all, which register is legally binding in the event of a dispute.

This Terreta Spain guide explains everything: the difference between the Cadastre and the Property Registry, what happens in the event of a discrepancy, and how to correct the situation before your sale.

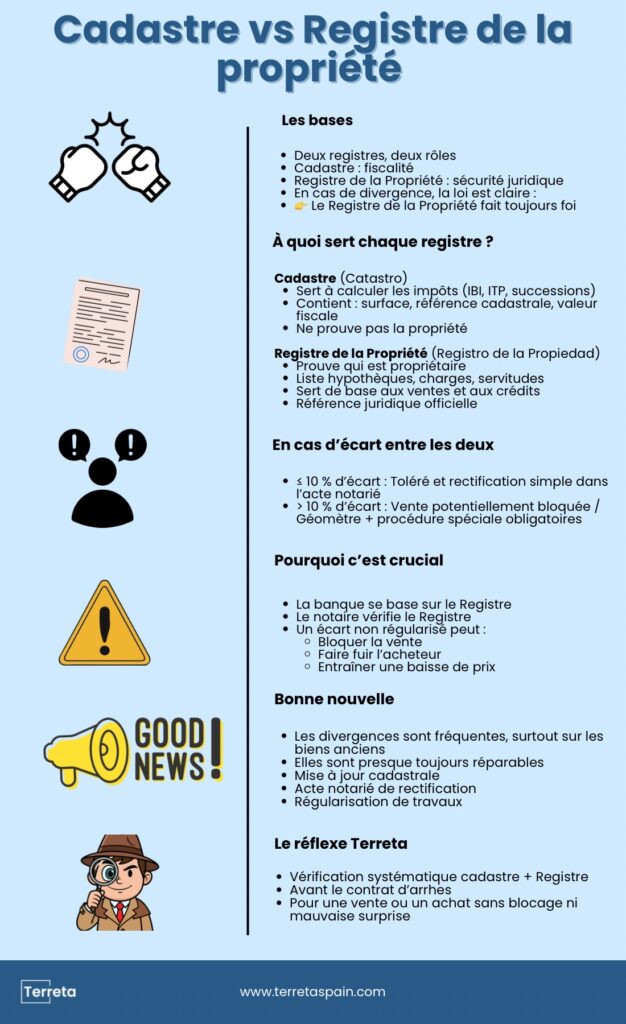

| In short: Cadastre vs Property Registry The Cadastre and the Property Registry are the two key documents for describing and legally securing real estate in Spain. Two documents, two roles: the Cadastre for taxation, the Property Registry for the legal security of your property in Spain. When the Cadastre and the Property Registry diverge, the law is clear: the Property Registry is authoritative. Maximum tolerance of 10%: beyond that, the sale may be blocked and requires a special procedure with a surveyor and legal publicity. Discrepancies are common (especially with older properties) but can almost always be resolved: cadastral update, notarized deed of rectification, regularization of works. Terreta Spain systematically checks the consistency of the Cadastre and Registry before signing the deposit contract to avoid any transaction blockages. Do you have any doubts about the documents to provide for the sale of a property in Spain? Contact our experts. |

Are you looking to sell your property in Spain? Discover our comprehensive guide.

Land Registry and Property Registry: what is the difference?

In Spain, there are two public registers that describe real estate properties, but they do not serve the same purpose at all:

The Land Registry (Catastro)

The Land Registry is an administrative register managed by the Department of the Treasury. Its main purpose is to serve as the basis for calculating taxes.

What is the purpose of the Land Registry?

- Calculation of IBI (Spanish property tax)

- Calculation of ITP (property purchase tax)

- Calculation of inheritance and gift taxes

- Definition of the reference value (minimum tax base for a property since 2022)

What the Land Registry contains:

- Physical description of the property (built area, usable area, number of rooms)

- Cadastral reference (unique property identifier)

- Geographic location

- Cadastral value (used as the basis for taxation)

Terreta info: Registration with the Land Registry is mandatory and free of charge. However, the Land Registry does NOT legally prove that you are the owner.

The Property Registry (Registro de la Propiedad)

The Property Registry is a legal registry attached to the Spanish judicial system. Its purpose is to secure property ownership.

What is the purpose of the Property Registry?

- Prove who is the legal owner

- Indicate the year of acquisition

- List any encumbrances on the property (mortgages, liens, easements, usufructs)

- Ensuring legal certainty in real estate transactions

What the Property Registry contains:

- Identity of the owner(s)

- Official description of the property (property number, registered area, location)

- Mortgages and encumbrances

- Legal restrictions (VPO, easements, urban planning restrictions)

Terreta info: registration in the Property Register is optional but strongly recommended. It costs a few hundred euros, but it legally protects your property rights.

In case of discrepancy, the Property Registry shall prevail.

Let's imagine: you are selling an apartment, the Land Registry indicates 90 m², but the Property Registry mentions 105 m². Which one is correct?

The answer is simple: the Property Registry always takes precedence.

Why? Because the Cadastre is a tax tool, whereas the Property Registry is a legal registry that legally guarantees ownership.

What does that mean in practical terms?

- If you are selling a property, it is the surface area recorded in the Property Registry that counts for the sale.

- If you apply for a mortgage, the bank will refer to the Property Registry, not the Land Registry.

- If you resell, the buyer (and their notary) will check the Property Registry first.

But be careful: even if the Land Registry has no legal value, a significant discrepancy could block your transaction. We explain why.

The 10% tolerance: the threshold you absolutely must know

In Spain, the law allows for a difference of up to 10% between the Cadastre and the Property Registry. Above this threshold, the notary and the registry may require regularization before registering the sale.

Difference ≤ 10%: no major concern

If the difference is less than 10%, the correction is made directly in the notarial deed, without any cumbersome procedures. The property can be registered normally in the Property Registry.

Example:

- Land registry: 95 m²

- Property Registry: 100 m²

- Difference: 5% → OK, we can record the sale without any problems.

Difference > 10%: special procedure required

If the difference exceeds 10%, the notary must open a mortgage file and provide a georeferenced graphic representation of the property (i.e., a technical plan drawn up by a surveyor).

Example:

- Land registry: 85 m²

- Property Registry: 105 m²

- Difference: 23% → Problem. Must be adjusted before the sale can be recorded.

Why is this important to you?

- If you sell a property with a discrepancy of more than 10%, the sale may be blocked until the discrepancy is resolved.

- If you sell a property with a difference of more than 10%, the buyer may back out or demand a price reduction.

- In the case of a purchase, if you are financing with a loan, the bank may refuse the loan until the situation is clarified.

Terreta Spain's advice: always check that the information in the Land Registry and Property Registry matches before signing the deposit agreement. That way, there will be no unpleasant surprises on the big day.

How can discrepancies between the Land Registry and the Property Registry be corrected?

Good news: in most cases, discrepancies can be easily corrected. You just need to know which record is incorrect and follow the correct procedure.

If it is the Land Registry that is incorrect

Situation: the actual surface area of the property corresponds to the Property Register, but the Land Registry is incorrect.

Solution:

- Request a cadastral update via a “cadastral declaration”

- Provide a technical report prepared by an architect or surveyor.

- Attach the notarized deed for the property

Timeframe: a few months after approval by the land registry.

Benefit for buyers: aligning the land registry with reality helps avoid overtaxation (excessive property tax, incorrectly calculated transfer tax) and clarifies surface areas before a future resale.

If it is the Property Registry that is incorrect

Situation: the actual surface area corresponds to the Land Registry, but the Property Registry is incorrect.

Solution:

- Obtain a report from a surveyor or architect confirming the correct area.

- Have a notarized deed of rectification drawn up by a Spanish notary

- File this document with the Property Registry for updating purposes.

Timeframe: several weeks to several months, depending on the complexity of the case and any objections that may be raised.

Interest for a seller: securing the sale.

Interest for a buyer: managing a mortgage or lot division without any unpleasant legal surprises.

If the difference is due to undeclared work

Situation: the owner has extended the property (extension, raised roof, enclosed terrace) without updating the Land Registry or Property Registry.

Solution:

- Check whether a municipal license is required

- Submit an urban planning project to the city hall

- Regularize the situation with an updated notarized deed

Please note: some buildings that do not comply with urban planning regulations may not be legalizable. You must check urban planning compatibility before buying or reselling.

Why it matters if you sell in Spain: to be compliant and avoid scaring off buyers.

Interest for a buyer: avoid purchasing a property with "illegal" square footage that could be contested or demolished by the city council.

If the difference exceeds 10%: special procedure

Situation: the difference in surface area exceeds 10%, and the notary requires a regularization procedure before registering the sale.

Solution:

- A surveyor must confirm the actual area.

- A legal notice is published.

- If there is opposition, the update must be validated by a judge.

Timeframe: several months, or even more than a year in the event of a dispute.

Advice for buyers: NEVER purchase a property with an unadjusted discrepancy of more than 10%. The legal and financial risk is too great.

Case study: selling a house in Valence with a discrepancy between the land registry and the cadastre

The context

Laurent and Marie, a French couple who have owned a 150 m² house in Valence for 15 years, decide to sell their property to reinvest elsewhere.

They contact Terreta Spain to manage the sale. Before putting the property on the market, the Terreta Spain team requests the nota simple (extract from the Property Registry) and the cadastral reference to verify that the file is in order.

The problem detected

- Land registry: 170 m² built

- Property Registry: 150 m²

- Difference: 13.3% → beyond the 10% tolerance

Upon further investigation, we discover that Laurent and Marie enlarged the kitchen and added an extension to create an office eight years ago, but without declaring the work or updating the Property Register.

The risk for sellers

Without regulation, several catastrophic scenarios could occur:

- The buyer backs out at the last minute when they discover the discrepancy during the signing at the notary's office.

- The buyer's bank refuses the loan because the property does not match the land registry and the register.

- The notary blocks the registration of the sale until the situation is clarified.

- The buyer is demanding a price reduction of €20,000 to "compensate for the risk" of the 20 m² that has not been regularized.

The solution implemented by Terreta Spain

Terreta Spain coordinates with a local architect for:

- Check the urban planning compatibility of the extension (OK, the work complied with the urban planning regulations in force at the time).

- Obtain a retroactive certificate of completion of work from the town hall.

- Update the Property Register with a notarized deed of rectification to officially register the 170 m².

Deadline: 3 months.

The result

Laurent and Marie are selling their property with an officially registered surface area of 170 m² in the Property Registry, consistent with the Land Registry.

Concrete benefits:

Smooth sale, with no notarial delays or buyer backtracking

Optimized sale price: the additional 20 m² are legally valued

Secure transaction for the buyer, who easily obtains their mortgage

No future legal risk for Laurent and Marie

Without this advance regularization?

They could have lost the buyer, been forced to lower the price, or worse, been stuck with an unsellable property for months while they rushed to regularize the situation under pressure.

Terreta Spain's advice: always check that the land registry and property registry information match before putting a property up for sale. That way, the transaction will be completed at the right price, without stress, and on time.

Why Terreta Spain systematically checks the Land Registry and Property Registry when buying or selling a property

At Terreta Spain, we never sign a deposit agreement without first checking that the information in the Land Registry, Property Registry, and the physical reality of the property match. Similarly, when selling a property, our experts check that all the information is consistent.

Our systematic checklist:

- Request for a simple note (Property Registry)

- Verification of the cadastral reference

- Comparison of areas (built, usable, plot)

- Verification of the property description (number of rooms, outbuildings, garage)

- Detection of undeclared work

- Analysis of registered liens and mortgages

Result: you make an informed purchase, with a clean and secure file.

FAQ: Cadastre (catastro) vs Property Registry (Registro de la Propiedad) in Spain: which is authoritative in the event of a discrepancy?

What are the Land Registry and Property Registry used for?

The Land Registry is used to locate the property, describe its characteristics, and calculate taxes (property tax, cadastral value, reference value) for the tax authorities. The Property Registry is used to prove who owns the property and what encumbrances (mortgages, easements, etc.) are attached to it, providing legal certainty that is enforceable against third parties.

What is authoritative in the event of a discrepancy between the Cadastre and the Property Registry in Spain?

The Property Registry always takes precedence over the Cadastre for all matters relating to property, real rights, and encumbrances. The Cadastre is primarily for tax purposes and is not proof of ownership in itself.

Is it a big deal if there is a difference between the Land Registry and the Property Registry?

Small differences in surface area or description are very common, especially in older properties. A significant discrepancy can prevent registration in the Land Registry, block the sale, or complicate bank financing.

What is the 10% rule regarding the Land Registry and Property Registry?

If the difference in surface area between reality/plan, Cadastre, and Register is less than or equal to 10%, a simple correction without cumbersome procedures is generally possible. Above 10%, the notary must open a specific file (expediente hipotecario) with a georeferenced plan, which increases delays and costs.

How does Terreta Spain assist you in the event of a discrepancy between the Cadastre and the Property Registry?

A sale with a discrepancy of more than 10% carries a high risk of refusal of registration, credit blockage, or price renegotiation until the situation is resolved. Hence the importance of checking the consistency of the Land Registry and Register (surfaces, boundaries, owner, charges) before signing the deposit agreement and, if necessary, initiating a land registry update, rectification deed or urban planning regularization.