Introduction

The British have always topped the podium as the biggest foreign investors in Spanish real estate. But since the Brexit, conditions have changed: taxation, residency rights, administrative formalities, etc.

Here's everything you need to know about buying in Spain from the UK in 2025.

Can Britons still buy in Spain?

Nationality and purchasing

Yes, even after Brexit, Brits can buy in Spain without any special restrictions .

- Nationality and country of residence have no impact on the purchase; they only affect residency rights and taxation.

Like all investors, Britons simply need to be able to secure the financing for their property and comply with the administrative formalities, which differ depending on where they live for tax purposes.

Please note: there is one exception. In certain sensitive or strategic areas, such as border or military zones, authorization from the Ministry of Defense is required for buyers who are not EU residents(Royal Decree 689/1978).

- Good to know: if you are concerned, you can ask your questions by writing to this official e-mail address: inviedbuzon@oc.mde.es

The 90-day rule

Since the Brexit, British citizens can stay in the Schengen area, including Spain, for up to 90 days out of a 180-day period without a visa. For longer stays, they must apply for a non-lucrative visa (one year maximum).

Please note: if you are applying for a non-lucrative visa, you will be asked to provide proof of financial means. The aim of the Spanish authorities is to check that you can support yourself without working.

British citizens wishing to invest in Spain should be aware that they cannot stay in the country for more than 3 months. If this is your case, enlist the help of Terreta Spain's experts to buy property from the comfort of your own home, without wasting time or money on endless formalities or plane tickets.

The role of non-resident buyers in Spanish real estate

The Spanish real estate market

In 2025, the Spanish real estate market remains very dynamic. Demand is strong and prices are rising throughout the country:

- +14% on purchase between June 2024 and June 2025 (Idealista).

- +9.7% for rentals over the same period (Idealista).

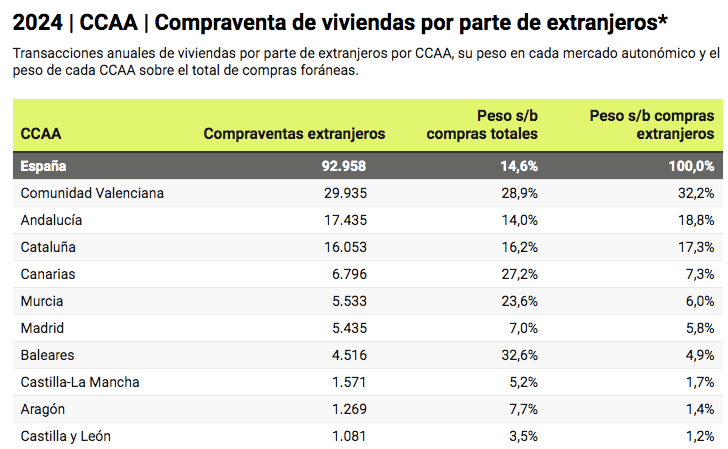

This sharp rise is not holding back foreign buyers, whose purchasing power is often greater than that of Spanish buyers. In 2024, foreigners accounted for 93,000 of the 636,000 transactions recorded, or 14.6%. A record (Idealista).

They remain attracted by investment in tourist areas, on the Mediterranean coast and on the islands in particular.

- In the Balearic Islands, 32.6% of real estate transactions involved a foreign buyer in 2024.

- In the Valencian Community: 29%.

- In the Canaries: 27%.

- In the Murcia Region: 23.6%.

Legend: Real estate transactions by foreigners, by Autonomous Community (2024)

Source: Idealista

British buying in Spain

Purchase volume

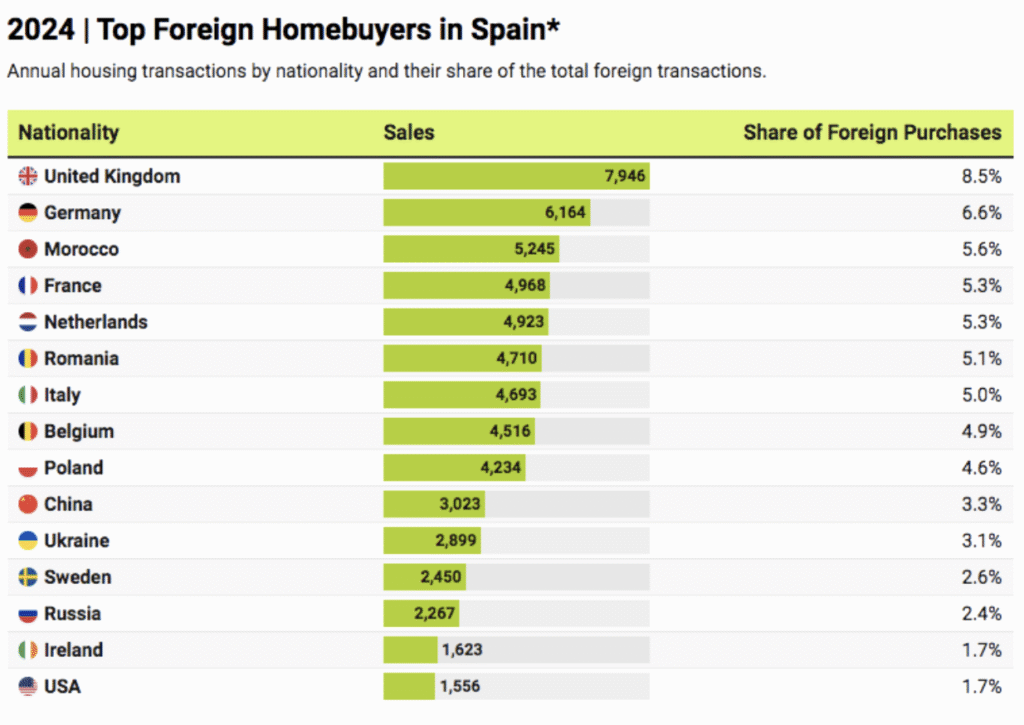

In 2024, the British took the gold medal as the leading foreign investors in the country, with almost 8,000 properties purchased. This represented 8.5% of all transactions carried out by foreigners. By 2019, they had purchased 15% of available properties. Since then, the decline has been clear and is most likely due to the uncertainties generated by Brexit.

German and Moroccan buyers are now hot on the heels of the British.

Legend: Ranking of foreign purchases in Spain by nationality, 2024

Source: Idealista

Type of purchase

According to data collected by Idealista's research department, Britons tend to target :

- Mid-range and upper-range properties.

- 100 m² on average.

- They pay over €3,000/m², as do most non-residents (compared with €2,300/m² for residents).

Administrative procedures for non-resident buyers

Steps common to all foreign buyers

All foreign buyers, whether resident in Spain or not, must provide :

- A NIE(Numéro d'Identification des Étrangers).

- A Spanish bank account.

- Proof of funds.

These formalities are essential for a successful real estate transaction in Spain.

To find out about all the stages involved in buying property in Spain, our teams highly recommend reading these two comprehensive articles:

Administrative specifics and tax implications for English buyers post-Brexit

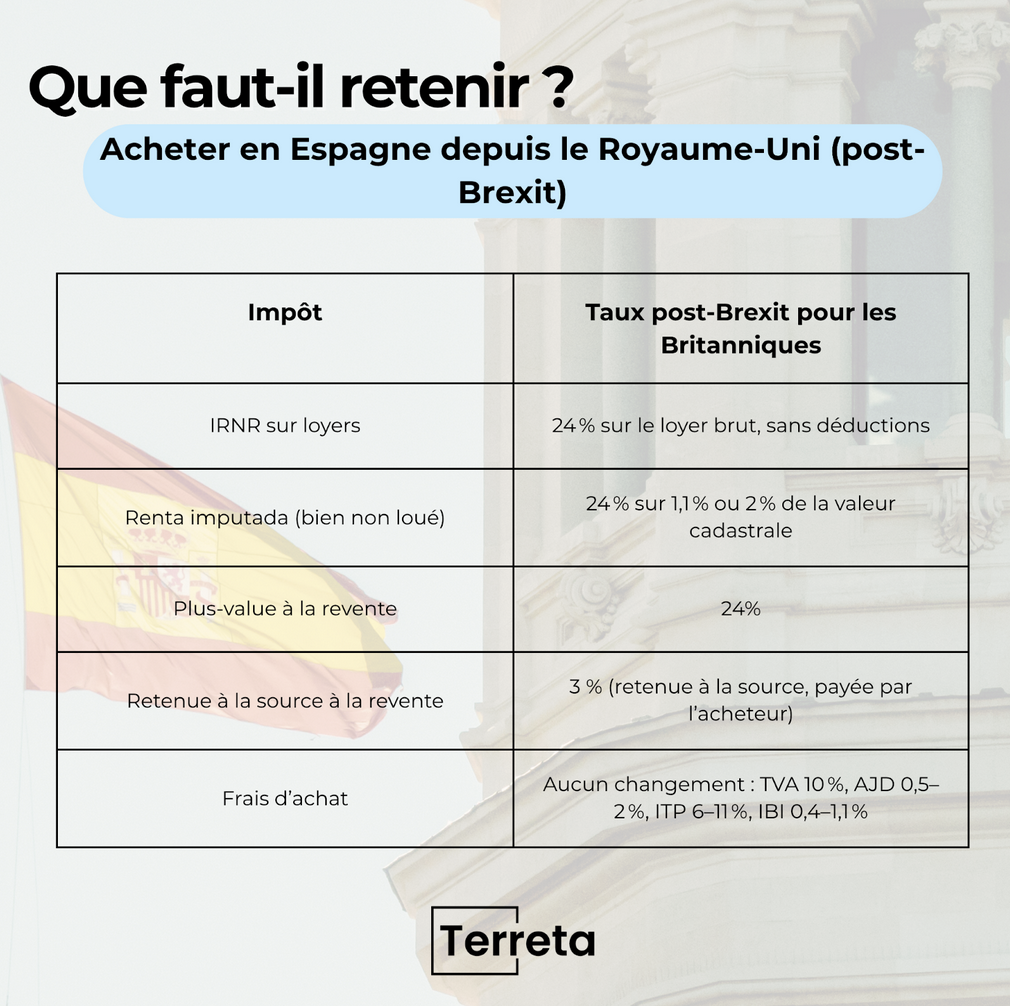

Before the Brexit, buying conditions for Britons were the same as for French, Italians or any other European tax resident. Now, they have to comply with the less advantageous rules for citizens residing outside the EU or European Economic Area.

Here's what's changed.

Can Britons still get credit in Spain?

Yes, Britons can obtain a mortgage in Spain. However, the conditions offered by Spanish banks to non-residents are less advantageous, and they are even stricter for non-EU residents:

- Rates are generally between 3% and 5% , depending on the case (summer 2025). For the British, the figure is closer to 4-5%.

- Credit terms generally do not exceed 20 years.

- The loan amount is limited to 60-70% of the property price.

- All documents must be translated and apostilled.

- Britons are more likely to get a loan if their application is backed by a UK financial product, or if they can release equity in a property in their country of residence.

Good to know: some British banks offer international loans. These include NatWest International, Barclays Expats andHSBC.

To find out more about this topic, and to discover the list of documents required by Spanish banks, read our dossier: "Mortgages in Spain for non-residents: the complete guide".

Taxation of British rental income (post-Brexit)

On this point, the British have clearly lost out.

- Before the Brexit, British landlords were liable for 19% net of their rents. They could deduct numerous charges (loan interest, condominium fees, IBI, etc.) from their IRNR(Impuesto sobre la Renta de No Residentes).

- Post-Brexit, they have to pay the Agencia Tributaria, 24% on gross rents received, they can't deduct charges. Not cool.

Good to know: even if you don't rent out your property for all or part of the year, the Spanish tax authorities consider that your property generates fictitious income(imputación de renta inmobiliaria para no residentes or renta imputada). It is therefore imputed and taxed at 24% of the property's cadastral value.

Calculation of renta imputada

The tax base is equal to 1.1% or 2% of the cadastral value.

- 1.1% if the value of the property was revised after 1994.

- 2% if not.

The amount of tax is calculated as follows: Tax = (cadastral value x 1.1% or 2%) x 24%.

Case in point:

For a property with a cadastral value of €100,000 that has not been revised:

- Income imputed: 2% x 100,000 = €2,000

- Tax payable: 24% x 2,000 = €480

To find out more, read our Renta Imputada factsheet.

Insert renta imputada fact sheet here

Resale capital gains tax for UK residents

In Spain, like residents, non-residents must pay capital gains tax (ganancia patrimonial) when they sell a property that has appreciated in value. Before the Brexit, Britons had to pay 19%.

- Since the Brexit, a rate of 24% applies with no deductions possible(article 25.1.b Ley del IRNR). This is the case for all non-residents living outside the EU.

Good to know: when a property is resold by a non-resident owner, the tax authorities deduct 3% of the withholding tax to prevent tax evasion. The tax is paid by the buyer.

Comparative table: property taxation for EU residents vs. non-EU residents

| Type of income | EU or EEA resident | Non-EU or EEA resident |

| Rental | 19% with possible deductions | 24% without deductions |

| Added value | 19% with possible deductions | 24% without deductions |

| Withholding tax | 3% of sales price | 3% of sales price |

Risk of double taxation?

On this side, British nationals can rest easy. A bilateral Spain/UK treaty came into force in 2014. It guarantees the avoidance of double taxation on gains or rental income.

The debate in the press: towards a 100% tax on non-EU residents?

In 2025, Pedro Sanchez caused a stir when he raised the possibility of a dissuasive tax of 100% of the price for non-EU buyers. His aim? To make it easier for Spaniards to buy their own homes, in order to curb the country's housing crisis. Prices have risen sharply since Covid, driven in particular by foreign demand.

No legislation has yet been passed, and it seems unlikely that it ever will be, but this debate is helping to create uncertainty among potential investors.

Other real estate taxes

For other taxes relating to the purchase or ownership of property in Spain, rates remain unchanged. They are the same for both residents and non-residents.

- IBI (property tax)

- ITP(Impuesto sobre las Transmisiones Patrimoniales)

- AJD (Tax on Documented Legal Acts)

- IVA (new-build VAT)

To find out all you need to know about investment-related taxes, read our practical information sheet: "Costs when buying property in Spain".

At Terreta Spain, we support every Briton in his or her real estate project in Spain, with tailor-made legal, tax and administrative support. Contact us, "we'll do it for you."

Sources: Notaires d'Espagne, Idealista, INE, IberianTax

FAQ - Buying property in Spain from the UK (2025)

Can Brits still buy property in Spain after Brexit?

Yes. The Brexit does not prevent buying in Spain. British nationals can still acquire property without restrictions, except in certain military or border areas requiring special authorization from the Spanish Ministry of Defense.

How long can a British citizen stay in Spain without a visa?

Since the Brexit, tourist stays are limited to 90 days out of 180. To stay longer (for example, to supervise a real estate project on site), you need to apply for a non-profit or investor visa.

Can Britons get a mortgage in Spain?

Yes, but the conditions for non-EU residents are stricter:

- Interest rate: between 3% and 5%.

- Term: maximum 20 years

- Financing: up to 60-70% of the property price

- File: translated and apostilled documents required

British banks such as NatWest International, Barclays Expats and HSBC also offer international loans.

What tax treatment applies to British rental income?

Since the Brexit, British landlords have been liable to pay 24% on gross rents received (without any deduction of charges). Even if the property is not rented out, a notional income is calculated (1.1% or 2% of the cadastral value), also taxed at 24%.

How much resale tax do Britons pay?

Non-EU residents are subject to 24% capital gains tax, with no deduction possible.

A 3% withholding tax is levied at the time of sale, by the buyer to guarantee payment of the tax.

Do Britons risk double taxation (Spain + UK)?

No. Spain and the UK signed a double taxation treaty in 2014. This avoids paying tax twice on the same rental income or property capital gain.