Spain is one of the most attractive real estate markets for international investors. Competitive prices, a favorable climate and strong rental demand are just some of the advantages that make it an ideal destination for diversifying assets and generating sustainable returns. But behind this potential, certain legal, financial and administrative specificities can surprise foreign buyers.

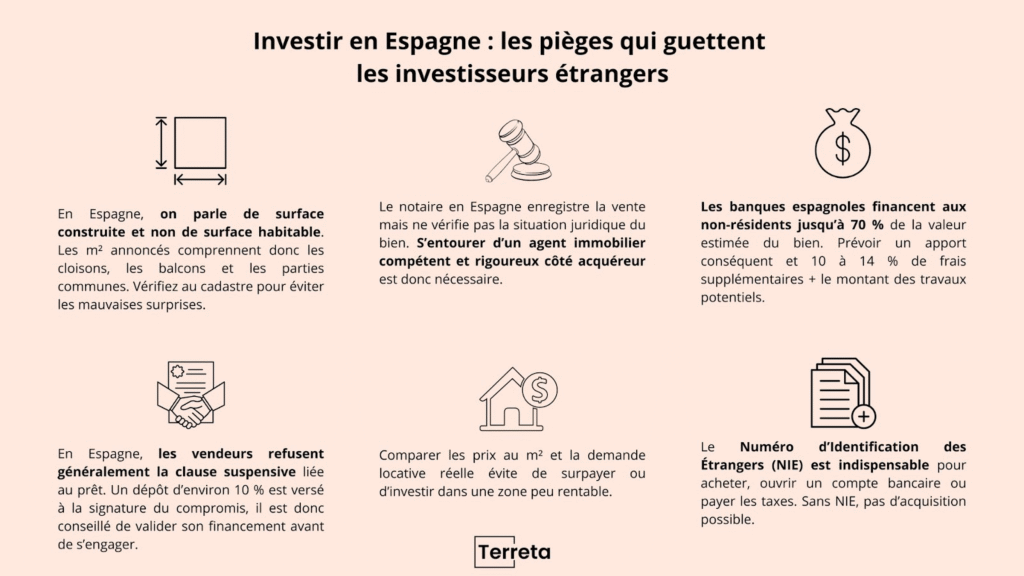

To secure an investment and protect your capital, it's essential to be aware of the main pitfalls: differences in surface area calculations, the limited role of the notary, the absence of a suspensive clause, more restrictive financing, and compulsory formalities. Here's a clear, practical overview of the mistakes to avoid.

Actual surface area vs. advertised surface area: how to read m² in Spain

First scam: the surface area of housing. In Spain, two measurements coexist: built m² and useful m². Property advertisements almost always mention the constructed surface area, which is more advantageous on paper, but includes walls, partitions, balconies and sometimes a share of common areas. Useful m², on the other hand, corresponds to the actual living area. As a result, an apartment advertised at 100 m² constructed may offer only 75 to 80 m² of living space.

Terreta Spain's advice: To calculate rental profitability correctly, it's essential to check land registry areas.

Notary, lawyer, real estate agent: who really secures your purchase?

Contrary to popular belief, a lawyer is not always essential when buying a property in Spain, especially when buying a standard apartment. What's really important is to be surrounded by a competent real estate agent on the buyer's side, capable of securing the transaction.

A number of essential points can be dealt with without a lawyer, as long as you are meticulous: the legal status of the property, verified by means of the the Nota Simplean official document indicating the existence of any mortgages, debts or proceedings in progress; the status of condominium charges, checked by a certificate signed by the property manager, which the vendor must provide before signing; coordination with the notary, who registers the sale but does not carry out any in-depth checks, can be effectively ensured by an experienced real estate agent.

Another important point concerns the debts attached to the property. In Spain, it is not the seller but the buyer who becomes responsible for these after the transaction. Mortgages, unpaid local taxes or unpaid condominium charges: these are all liabilities that can be passed on with the property. This information is contained in the Nota Simple, the property register's identity card. It is therefore essential to check this document before making any commitment.

Terreta Spain experience: since 2022, we have completed over 150 acquisitions for our investor clients. Only in two specific cases has it been necessary to call in a lawyer, to deal with houses with undeclared extensions or town-planning issues. In short, it is perfectly possible to secure a property purchase in Spain without a lawyer, provided you are well supported by a rigorous real estate agent on the buyer's side, and know how to call on a legal professional if a particular situation requires it.

To secure your real estate investment in Spain, contact a Terreta Spain advisor today.

Financing in Spain: a larger contribution than in other European countries

In Spain, banks generally offer non-residents financing of up to 70% of the property' s appraised value . the estimated value of the property. This means that a down payment of 30 to 40% is almost always required. Added to this are 10 to 14% in ancillary costs (taxes, notary, registration, legal support), as well as the cost of any renovations.

In many European countries, the level of financing can be higher, with loans often covering up to 80% or more of the property's value, even for non-residents. Spain therefore requires foreign investors to arrive with a stronger cash position.

Loan terms are generally between 15 and 20 years, although some establishments offer 30-year financing under certain conditions. This is not an obstacle to investment, but it does require careful preparation of the financing plan.

Read our full report and find out everything you need to know about mortgages in Spain for non-residents.

And to make sure you don't underestimate your contribution, run a simulation with our Terreta Spain calculator.

Spanish compromise: a firmer commitment than elsewhere in Europe

In many European countries, the preliminary sales agreement includes a suspensive clause linked to obtaining a loan, protecting the buyer in the event of financing being refused. In Spain, this practice is not common, and sellers generally refuse to include such a clause.

When signing the compromise, called contrato de arrasthe buyer pays an average of 10% of the price of the property. If financing is not granted, this sum is forfeited. Conversely, if the seller withdraws, he must return the deposit and pay an equivalent indemnity. The Spanish compromise is therefore much more binding than in most European markets.

Terreta Spain's advice: To avoid any difficulties, it's advisable to pre-qualify your financing before taking a position on a property.

NIE: the administrative sesame for any investment

The Foreigners Identification Number (NIE ) is required to buy a property in Spain. Without this document, it is impossible to sign the final deed, open a bank account or pay certain taxes.

Obtaining the NIE can be time-consuming, especially in large cities or tourist areas. Since 2022, a provisional tax number can be issued by the notary to speed up the sale, but it must be regularized within three months. In the case of a joint purchase, each buyer must have his or her own NIE.

Study the local market: avoid overpaying for your investment

The Spanish market attracts many foreign investors, which can artificially drive up prices in some popular areas. It is therefore essential to compare the price per square metre with recent transactions in the same area, and to assess actual rental demand. Advertisements can be misleading, especially when they show "built" surface areas instead of "useful" ones, or play on an artificial scarcity effect.

Terreta Spain's advice: beware of overly tempting offers, as they often conceal legal or urban planning irregularities. The best way to secure your project is to be accompanied by local market experts.

Ready to buy in Spain? Our practical guide "The Terreta Spain guide to investing in Spain" tells you how.

In short: secure your capital with expert support

Buying in Spain is no more risky than elsewhere, but there are a number of pitfalls specific to the country that may surprise foreign investors. Differences in the calculation of surface areas, the limited role of the notary, more restrictive financing, the absence of a suspensive clause, the obligation to obtain an NIE or even debts associated with the property: these are just some of the particularities you need to be aware of to invest in complete security. Being accompanied by experts in the Spanish market, such as Terreta Spain, protects your capital and maximizes the success of your real estate investment.

More than 150 foreign investors have already completed their projects with Terreta Spain. Why shouldn't you? Contact us now.

FAQ : Real estate in Spain: pitfalls to avoid for a successful investment

What are the main real estate pitfalls in Spain for foreign investors?

The most frequent concern the surface areas advertised (m² built vs m² used), the limited role of the notary, the absence of a suspensive clause in the compromis, the high deposit required by banks, the debts that can be attached to the property, and the obligation to obtain an NIE before signing.

What's the difference between built and usable square meters in Spain?

Built m² includes walls, partitions, balconies and sometimes a share of common areas. Useful m² correspond to the actual living area, generally 20 to 25% less. Checking the land registry is essential to avoid unpleasant surprises.

Does the Spanish notary play the same role as in France or other European countries?

No. In Spain, the notary's role is limited to formalizing and registering the transaction. He or she does not verify the full legal status of the property. Checks must be carried out beforehand, by a competent real estate agent or, in certain specific cases, by a lawyer.

What are the costs to be expected in addition to the purchase price?

In addition to the price of the property, you need to allow for 10 to 14% in ancillary costs (taxes, notary, registration, any legal fees). These costs are in addition to the down payment, which is often higher than elsewhere in Europe.

How much do Spanish banks charge non-residents?

Most banks will finance 60-70% of the estimated value of the property. The buyer must therefore have a personal contribution of 30 to 40%, to which ancillary costs must be added. Loan terms are generally 15 to 20 years.

Why is the suspensive clause rarely accepted in Spain?

The suspensive clause linked to obtaining a loan is not common practice in Spain, and sellers generally refuse it. When signing the compromis, the buyer pays 10% of the purchase price. If financing is refused, he risks losing this sum.

What is NIE and why is it essential?

The Numéro d'Identification des Étrangers (NIE) is required to purchase property, open a bank account or pay certain taxes. Without an NIE, no acquisition is possible. Each purchaser must have his or her own number.

How can I avoid overpaying for a property in Spain?

It's essential to compare the price per m² with recent transactions in the area, and to assess actual rental demand. Advertisements can be misleading, especially if they emphasize built-up rather than usable surface areas.