The Essentials in a Few Words

Seeking real estate financing is the first step in your project.

Looking for a mortgage is the first step in your project to buy property in Spain.

You need to take care of this before you even start looking for apartments. Terreta Spain can help you with your credit search, and save you from making costly mistakes.

It would be a shame to look for a property for sale, find a gem, and then stress when making a purchase offer for fear of not obtaining financing.

Especially in a country where financing contingency clauses are very often rejected by sellers.

Spare yourself this by validating your financing before starting your search; it will be much more comfortable for you.

In Spain, more than half of real estate sales are made without resorting to bank financing. Therefore, sellers have no reason to accept an offer made with a financing contingency clause.

Practical advice from Terreta: contact several banks

Never depend on a single loan broker, never depend on a single bank.

Have you contacted just one financing broker, and does that seem sufficient to you? Or are you talking to just one bank, and do you think that's enough?

No, that's not enough. A loan broker, just like a banker, could have a health issue, for example, and your application could end up being blocked. So never rely on a single contact for financing.

Important: contact at least 3 banks, or two banks and a loan broker.

Financing conditions

Be aware that you will not obtain the same financing conditions if you are a Spanish tax resident or a « non-resident », i.e., a non-Spanish tax resident. Depending on your profile, what will be the bank conditions for your loan?

Spanish tax resident, or non-resident?

Spanish tax resident: 70% to 80%

If you are a Spanish tax resident, a bank will finance 70% to 80% of the property price if it is the purchase of a second home or a rental investment. For a primary residence, this percentage will be 80% to 90% of the property price. The duration of the loan granted will be 15 to 25 years, or even 30 years with certain (rare) banks such as UCI bank (Union de Créditos Inmobiliarios), which grants loans over this period.

How can you tell if you are a Spanish tax resident?It's very simple. If you are a Spanish tax resident, it means that youpay your taxes in Spain and therefore have an IRPF (Personal Income Tax)return for the previous year.

Non-resident: 60% to 70%

Spanish banks use the term "non-resident" to refer to any person whose tax residence is located in a country other than Spain. If you pay income tax in France, Belgium, Germany, Switzerland, or anywhere else in the world, you are therefore a "non-resident" for Spanish banks.

Is it possible to obtain a loan from a Spanish bank while being “non-resident"? ? Yes, without any problem.

If you are non-resident, you can obtain a mortgage from a Spanish bank or from a bank in your country of tax residence (under certain conditions). If you wish to obtain a mortgage from a Spanish bank, the loan conditions will be as follows:

-

- Loan term: generally from 15 to 20 years. You can also obtain a loan over 30 years with UCI bank (Únion de Créditos Inmobiliarios). Be careful, however, this bank will only grant you a loan over this period if you tell them that you are making the purchase of a second home. If you talk about rental investment, they will not grant you credit. Nothing prevents you from talking about a second home, even if you plan to rent the property later.

-

- Financing: 60% to 70% of the purchase price.

Banks that finance a real estate purchase in Spain

Terreta's practical advice

Are you actively seeking financing? If so, you will undoubtedly want to know which banks and financing brokers can help you finance your purchase in Spain.

Scenario 1: if you already have significant assets

If you own significant real estate (or financial) assets in France, Belgium, Germany, or in your country of tax residence, a French bank (or even a Belgian, Swiss, German, or Luxembourg bank) may agree to finance the purchase of real estate in Spain, via a transferred guarantee or asset pledge.

Here is a French broker who works on this type of operation:

We also have Belgian clients who had their purchase in Spain financed by the Banque de Luxembourg, using the same model of relocated mortgage guarantee (on a Belgian property).

Scenario 2: if scenario 1 is not possible, you are like 99% of our clients and we will obtain a mortgage directly from a Spanish bank.

Free financing brokers for the client (paid by the bank):

Paid financing brokers:

-

- French: Lluis Coma – contact@comacourtage.com

-

- English: MortgageDirect

-

- Spanish: Rafael Espejo Pujol-Busquets or Javier de la Mata (javierdelamata.kiron@gmail.com).

Banks that regularly finance our clients:

-

- CaixaBank - we recommend that you contact Juan Manuel Navarro, manager of a particularly efficient branch in València (juan.m.navarro@caixabank.com). They generally offer very attractive deals.

- Sabadell - but not just any branch: the Welcome Hub, the only banking entity in Spain entirely dedicated to expatriates and international customers. Headquartered in Barcelona, it provides support for property purchase projects throughout the country.

-

- ABANCA - I currently have two mortgages with this bank. Little known to foreigners, it is nevertheless very efficient and responsive overall. It recently acquired Targobank (Tomamos Impulso), previously owned by Crédit Mutuel.

-

- Banco Santander - Spain's largest bank, if you're under 35 take a look at their "Hipoteca Joven".

-

- BBVA – 2nd largest bank in Spain.

-

- Bankinter

-

- iberCaja

-

- Kutxabank

-

- HSBC

-

- CIC Iberbanco

And a little magic contact to finish in style: the only bank that grants mortgage loans over 30 years (!) while other banks finance non-residents over 15 to 20 years in general:

-

- Banco UCI (subsidiary of BNP Paribas and Banco Santander)

Warning: with this bank, do not talk about investment! Talk about buying a "secondary residence", otherwise they will close their doors.

Terreta's practical advice #2

It is better to talk about buying a secondary residence rather than saying that you are making a rental investment.

Indeed, some banks will refuse to finance an "investment".

Even if they agree to grant you a loan, they will not apply conditions as advantageous as if you talk about buying a second home: less attractive interest rates, shorter terms.

However, you risk nothing by talking about a second home, because once the mortgage loan is granted, the banks will not check whether you rent the property in question.

Should you take out a mortgage in Spain, or seek financing in your country of tax residence?

Obtaining a mortgage in your country is possible (under conditions)

It is possible to obtain a mortgage in your country of tax residence to finance your purchase in Spain. But this option is not open to everyone. Indeed, this possibility will only be offered to you if you have significant financial or real estate assets.

A bank in your country will ask you to provide solid guarantees of your assets in your country of residence.

For example: a main residence free of debt (or with a significantly paid-off mortgage) on which a bank could place a relocated mortgage guarantee, or the pledge of a life insurance policy, or the pledge of other assets in your possession.

Why would a bank in your country finance a purchase in Spain only under these conditions?

A bank in your country of tax residence cannot establish a mortgage guarantee on a property located in Spain.

Therefore, it will need guarantees located on national soil. This is referred to as "relocated guarantees."

How does the mortgage loan work in Spain?

For Spanish tax residents, it's quite simple: 70% to 80% of the property price for the purchase of a second home or a rental investment, and 80% to 90% for the purchase of a primary residence.

For non-residents, the rule is to obtain financing for 60% to 70% of the property price. Among these two options, the most frequent is 70%, which is good news.

Foreign buyers, you can obtain a mortgage from a Spanish bank

Spanish banks grant mortgage loans to foreign buyers, whether they are expatriates in Spain and therefore Spanish tax residents, or whether they are Spanish tax non-residents.

A few exceptions to note: if you are a tax resident of a country outside the European Union, if your income is not denominated in euros, many Spanish banks will refuse to consider your application.

Finally, if you are a tax resident of distant countries (America, Africa, Asia, Middle East), many Spanish banks will simply not grant you a mortgage.

You will have to buy without resorting to credit.

Time to obtain a loan: 1 to 3 months

Our advice: contact banks before you start looking for a property, as obtaining financing usually takes 2 to 3 months.

At a minimum (but don't count on it), it takes 1 month. The delays depend in particular on the responsiveness of the banks' "risk" departments.

This will allow you to gather all the supporting documents and pre-validate your application.

This is vital because the search for financing is the longest step in your purchasing process.

Move quickly in your search for a mortgage, because in Spain most sellers refuse clauses of "non-obtainment of credit".

When you make an offer, it is therefore final.

What happens in case of loan refusal?

If you do not obtain your financing, you generally lose 10% of the amount of the property, which you pay to the seller to reserve the property as a deposit or "Arras" in Spanish.

Why? Because in most regions of Spain, the "non-obtainment of credit" clause is systematically refused by the seller.

You can always try to make an offer with this clause, but there is a good chance that your offer will simply not be considered.

There is therefore no purchase offer without first being certain of obtaining financing.

So follow our advice: start your financing search as early as possible, even before you have found your future apartment. This will allow you to look for properties that fit your budget and your personal contribution.

What percentage of the property price does the bank finance?

Spanish banks will finance a percentage of the cost of your property purchase that varies depending on your country of tax residence.

The percentage of the property price financed by a Spanish bank will be as follows:

-

- 60% to 70% of the property price (or the "tasación") for Spanish tax non-residents who are, however, tax residents of the European Union.

-

- 50% of the property price for non-residents whose income is not denominated in euros, or who are tax residents outside the European Union.

-

- 70% to 80% for Spanish tax residents (including foreign expatriates in Spain).

Finally, for Spanish tax residents only, another case exists: the purchase of a primary residence. In this case, a bank will finance 80% to 90% of the property price.

The interest rate

The interest rate granted by Spanish banks is slightly higher for non-residents.

The difference applied by banks, compared to Spanish tax residents, is around 1%.

If you want to know the interest rates currently applied, head to the Idealista mortgage comparison tool.

Terreta's advice on interest rates

Many investors are obsessed with the interest rate, whereas the difference in monthly payments between a rate 1% higher or 1% lower is often very small.

Don't overemphasize the interest rate; put its weight into perspective factually.

To illustrate this, let's look at the difference between a loan at 4%, 5%, and 6% over a period of 20 years:

-

- €100,000 at a 4% interest rate over 20 years = €606 monthly payment

-

- €100,000 at a 5% interest rate over 20 years = €660 monthly payment

-

- €100,000 at a 6% interest rate over 20 years = €716 monthly payment

In other words, a 1% rate difference only creates a €50 difference in your monthly payment.

It's normal to look for the best rate, but don't obsess over it.

To maximize your cash flow, it's better to get a loan over a longer period than to slightly lower the rate.

Here's proof with a new illustration:

-

- €100,000 at a 5% interest rate over 20 years = €660 monthly payment

-

- €100,000 at a 5% interest rate over 30 years = €537 monthly payment

In terms of cash flow, extending the term is the most advantageous.

Simulate with HelpMyCash's calculator.

Fixed rate or variable rate?

Spanish banks almost always offer both options, but some banks may occasionally stop offering fixed rates and only offer variable rates.

This is particularly the case during periods of significant interest rate fluctuations.

Credit term

The general rules are as follows:

-

- 15 to 20 years for a non-resident

-

- 20 to 25 years for a Spanish tax resident

-

- 30 years in a bank with whom we collaborate, including for non-residents

To obtain a loan for a period of 30 years, contact UCI bank (Union de Créditos Inmobiliarios).

Please note: you must indicate that your project is the purchase of a second home. If you say it is a rental investment, they will refuse to grant you a loan.

Tip: nothing prevents you from saying that it is the purchase of a second home, to finally operate it as a rental investment. Banks do not come to check the destination of the property after the purchase.

Prepare your file carefully

Preparing a solid file is essential to obtaining a loan. Spanish banks consider a maximum debt ratio of 33%, unless the remaining disposable income is significant.

To be efficient and quick in the search for financing, it is important to gather all the necessary documents in advance.

Justify the origin of the equity

-

- The personal contribution is a key element

Since the bank generally only finances 70% of the price of the property, your personal contribution must generally represent 50% of the total cost of the project.

Indeed, you must plan 30% of the price of the property but also the notary fees, real estate agent fees, work and furniture if any.

In total, it is prudent to consider that your contribution will represent 50% of the total cost of the project.

As the amount of the contribution is significant, be aware that a Spanish bank or a notary will ask you to justify the origin of these equity.

So be prepared to explain that it is your savings related to your work, or an inheritance. The goal for them is to fight against money laundering.

Obtain your NIE

-

- The Foreign Identification Number: an essential step

Holding a NIE is mandatory for many official procedures in Spain.

This is especially necessary to buy a property, but also to open a Spanish bank account.

So, if you do not yet have your NIE, read our complete guide on the subject, which will explain how to obtain it and at what cost.

Summary table: Real estate loan in Spain

| Loan characteristics | Spanish tax resident | Non-resident |

|---|---|---|

| Financing percentage | Up to 80% | Between 60 and 70% |

| Type of interest rate | Variable or fixed | Variable or fixed |

| Borrowing rate | Market rate | Surcharge |

| Loan term | 20 to 30 years (standard) | 15 to 20 years (standard) Possibility of 30 years (rare) |

| NIE number | Mandatory | Mandatory |

Documents required for a loan application in Spain

List of documents – short version

The list of documents requested by Spanish banks includes:

-

- Proof of identity and family status.

-

- Proof of income and employment.

-

- Bank statements.

-

- Proof of property income, if applicable.

-

- Proof of address.

-

- Statement of real estate assets.

-

- Details of personal contribution.

-

- Foreign Identification Number (NIE).

List of documents – original and detailed version

In Spanish, and in a more complete version, here are the documents that Spanish banks will ask you to study your file:

-

- « NIE » = your Foreign Identification Number (see our complete guide on the subject)

-

- « IRPF » or « Impuesto sobre la Renta de las Personas Físicas » = declarations of your annual income. If you are not a Spanish tax resident, the tax form in your country of tax residence. Many banks will ask you for the last 2 years.

-

- « IRNR » or « modelo 210 » or « Impuestos pagados en España de este año por los alquileres recibidos » = declarations of your rental income in Spain, if you have any.

-

- « Contratos de alquiler de las viviendas en España » = lease agreements if you already have tenants in Spain.

-

- « Extracto 6 meses de la cuenta donde reciben los alquileres » = statement of your bank accounts over 6 months, where you receive rental income from apartments you own in Spain.

-

- « Extracto bancario de 6 meses en el que se acrediten los ingresos » = bank statements for the last 6 months, from the account to which your salary or income is paid.

-

- « Informe de crédito en su país de origen » or « Credit report » = document from your country of tax residence that proves that you do not have any repayment defaults in progress; in France, for example, this is the FCC (Fichier Central des Chèques) and FICP (Fichier national des Incidents de remboursement des Crédits aux Particuliers); how to obtain the FICP and FCC? Go to the Banque de France website.

-

- « Contrato de alquiler de la vivienda y las dos últimas mensualidades pagadas » = lease agreement for the property you rent as your primary residence (if tenant and not owner) and the last two rent receipts.

-

- « Contrato de arras de la vivienda que compran » = preliminary sale agreement for the property you are in the process of buying in Spain.

-

- « 2 últimas declaraciones de la renta » = your last 2 income tax returns, in Spain (if you have any) and in your country of tax residence.

-

- « 3 últimas nóminas y Contrato Laboral » = 3 last pay slips, and employment contract (if you are an employee).

-

- « Impuestos pagados (IVAs) (modelo 390 resumen) » = annual tax forms, and tax packages, income statements, annual balance sheets of your company (if you are an entrepreneur).

-

- « Vida Laboral » = your CV (Curriculum Vitae) to demonstrate your professional background.

-

- « Último recibo prestamos » = latest receipts for your current loans.

-

- « Detalle de propiedades (Dirección, porcentaje de titularidad, valor estimado y si está libre de cargas o tiene hipoteca) » or « propiedades: descripción, valor aproximado, deuda, ingresos mensuales si los hubiera » = details of the real estate you already own: addresses, ownership percentages (100% if you are the owner, 50% if, for example, you are co-owner with your wife, your husband, your sister in equal shares), estimated value of the properties, and information on current mortgage loans attached to these properties. If these are rental investments, rental income from these properties.

-

- « nota simple » = if you already own a property in Spain, the « nota simple » of these properties. You can obtain them on the Registradores website.

-

- « Detalles de las deudas: para qué son, por favor envíe el último reembolso mensual » = details of your debts: what are they for, by sending proof of the last monthly repayment, and why not the amortization schedule showing the repayments made and those to come.

-

- « Ahorros e inversiones: último extracto con su nombre y detalles del producto » = proof of your savings and investments: latest account statement with your name and product details, to demonstrate your savings, your liquid assets.

Example of a checklist of documents requested by Targobank

Banks do not all require the same supporting documents. To get a concrete idea of what a bank requires, here is the PDF that Targobank provides to its French clients.

What is the interest rate in Spain?

Average rates observed: 2% to 6%

Interest rates observed in Spain generally range from 2% to 6%, for terms ranging from 15 years to 30 years, depending on the buyer's profile.

This strongly depends on the evolution of rates and the pricing policies implemented by banks throughout the year. It is common to observe very different offers issued by banks for the same buyer, in terms of rate and term.

Therefore, be sure to contact several banks to obtain the best rate.

The criteria taken into account by banks include the country of tax residence, employment status (employee or self-employed), and the type of project (primary residence, secondary residence, or rental investment).

To find out the current interest rates, we advise you to contact different banks to obtain loan offers.

You can also consult the Idealista interest rate comparator (click here).

Average interest rate in 2025: 2% to 4%.

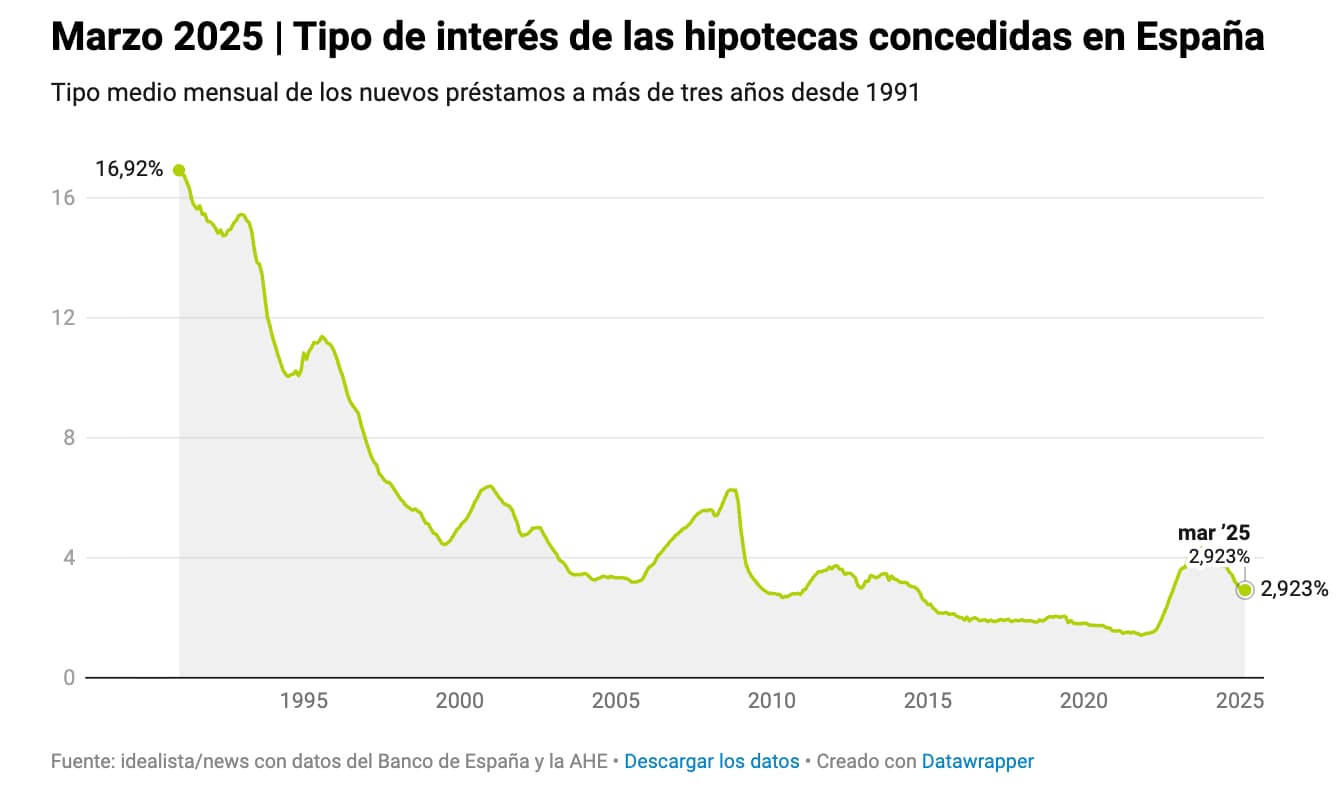

Between 1991 and 2023, the average interest rates observed on mortgage loans in Spain ranged between 1.50% and 17%.

In 2025, the average rate observed is 2% to 4% for terms of 15 to 25 years. This depends on the buyer's country of residence for tax purposes, as well as the quality of his or her file.

Chart showing interest rates on mortgages - 1991 to 2025

Rates have been rising since March 2022. Leaving aside the period from 2013 to 2022, when rates were historically low, today's rates are back to the normal levels seen over the period from 2000 to 2013. In 2025, interest rates granted by Spanish banks for home loans in Spain are excellent, at around 3%.