Investing in Spanish real estate is attracting more and more foreigners in search of sunshine and profitability. But beware: rental taxation can quickly become a headache if you don't master the rules of the game. Tax status, type of rental, country of origin... all criteria that influence the amount of tax payable.

This Terreta Spain guide is aimed at foreigners considering a rental investment in Spain.

Understanding real estate taxation in Spain: tax status and 2025 rates

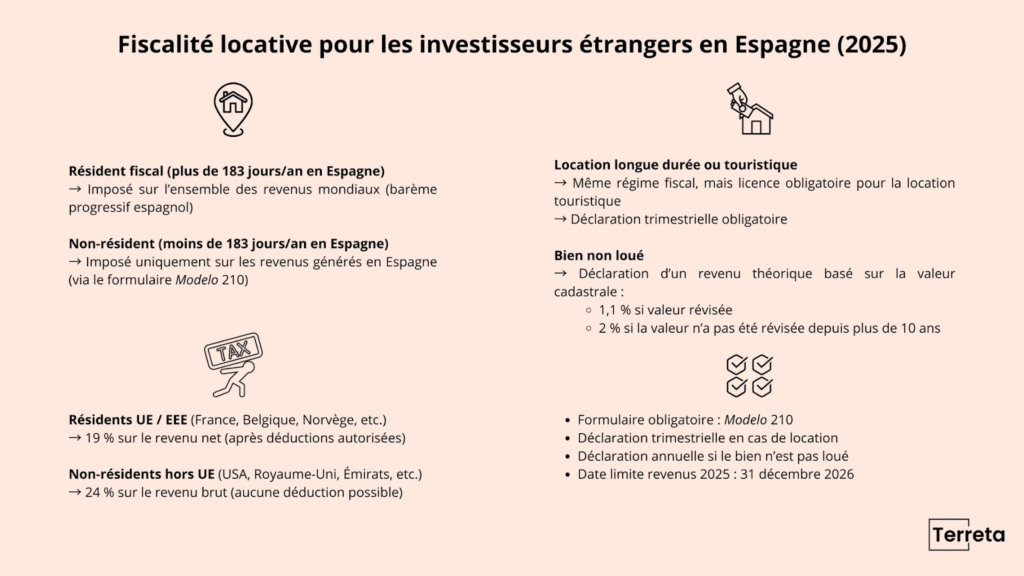

Spanish tax resident vs. non-resident

In Spain, an investor is considered a tax resident if he spends more than 183 days a year in the country. In this case, they are taxed on all their worldwide income, according to the Spanish progressive tax scale.

Conversely, a non-resident (less than 183 days/year in Spain) is only taxed on income generated in the country. Any non-resident receiving rental income must declare it forIRNR purposes, using the Modelo 210 form.

Rental taxation in Spain: tax rates in 2025

Among non-residents, tax rules also differ depending on whether you are a citizen of the European Union (or European Economic Area) or not.

- Investors resident in the European Union or EEA countries, such as France, Belgium, Norway or Iceland, are taxed at 19% on their net rental income. They can deduct rental-related expenses: interest on the loan, management fees, maintenance, insurance, condominium charges, local taxes, etc.

- On the other hand, non-European investors (e.g. British, American, Canadian or Emirati) are taxed at 24% on their gross rental income. No deductions are possible.

Ready to invest in Spain?

We'll help you find the right property, manage the rental process and comply with local tax regulations.

Talk to a Terreta real estate advisor today.

Tax returns for non-residents in Spain: what are the obligations in 2025?

Whether you rent your property on a long-term or short-term basis, the tax system applied to rental income is identical:

- EU/EEA resident investor → 19% of net income (deductible expenses allowed).

- Non-EU/EEA investor → 24% of gross income (no deduction possible).

The difference lies not in the tax rate, but in :

Administrative formalities

- Long-term: contract governed by the Spanish Urban Leases Act (Ley de Arrendamientos Urbanos).

- Short-term (tourist): generally subject to a tourist license, depending on the region (Catalonia, Balearic Islands, Andalusia, etc.), and sometimes to additional taxes (tourist tax).

Reporting obligations

- If the property is rented → non-residents must declare their income annually via the Modelo 210. Previously this obligation was quarterly, but this changed in 2024 with an official Spanish state bulletin ("Orden HAC/56/2024 de 25 de enero") which allows income to be declared annually.

- If the property is not rented → you still have to declare a fictitious income taxed at 1.1% or 2%(renta imputada), via a single annual declaration (always the Modelo 210) (insert renta imputada practical sheet once published).

Case studies (2025)

Here's how it looks in figures today.

Example 1: French investor (EU) - long-term lease

- Rental income: €18,000 / year

- Deductible expenses: €5,000 (loan interest, management, maintenance, insurance, IBI, condominium charges)

- Taxable income = €13,000

- Applicable rate: 19% (EU/EEA, deductible expenses)

= Tax due: €2,470 (13,000 × 19%)

Declaration: annual via Modelo 210.

Example 2: American investor (from outside the EU) - seasonal rental

- Rental income: €18,000

- Expenses incurred: €5,000 (but not deductible as outside the EU)

- Taxable income = €18,000

- Applicable rate: 24% (outside the EU, no deductions)

= Tax due: €4,320 (18,000 × 24%)

Declaration: annual via Modelo 210 + compulsory tourist license depending on region.

Example 3: Non-resident of France (EU) - property not rented out

- Revised cadastral value of the property: €80,000

- Theoretical imputed income: €880 (80,000 × 1.1%)

- Applicable rate: 19

= Tax due: €167.20 (880 × 19%)

Declaration: annual via Modelo 210, by December 31 of the following year.

These cases illustrate howrental taxes in Spain can vary greatly depending on your tax profile.

Looking to invest? We know the market, the procedures and the local tax situation.

Talk to a Terreta consultant for targeted, effective support.

IBI (Impuesto sobre Bienes Inmuebles)

IBI is a compulsory annual local tax in Spain, payable by all property owners, whether resident or non-resident.

- It is calculated on the cadastral value of the property.

- The rate varies by municipality (generally between 0.4% and 1.1% of the cadastral value).

- IBI must be paid every year, even if the property is vacant (not rented out).

- Non-resident owners must ensure that they pay this tax to their local council, or face penalties.

The IBI tax is independent of the income tax generated by the rental; it is a fixed charge that the owner must assume.

Watch out for tax changes

Tighter controls on tourist rentals

Since July 1, 2025, a single national register has required owners of tourist rentals to register via a digital counter. This system is designed to combat tax fraud, in particular by cross-referencing owners' banking and tax data to detect undeclared income.

Possible trends & developments (not voted in August 2025)

Certain measures are the subject of debate in Spain, but have not yet come into force.

- VAT on tourist rentals:

The government and certain regions have raised the possibility of subjecting short-term rentals to 21% VAT. Currently, this VAT only applies if the owner provides para-hotel services (e.g. daily cleaning, meals, reception). - There has been some discussion of a possible 100% surcharge on property purchases by non-EU residents, but to date no official initiative has been adopted or implemented.

Declaration obligations and practical advice

Non-residents must use Form 210 to declare their rental income each year. For 2025 income, the deadline is December 31, 2026.

Presentation

- The form can be filled in online and sent via the AEAT portal.

- You can also download it, fill it in and send it by post.

Payment methods

Payment can be made :

- By bank transfer.

- By direct debit if you have an account in Spain.

- By credit card directly on the tax authorities' website.

Sanctions and penalties

Failure to declare, or delay in declaring, Spanish non-resident income tax (IRNR) can result in severe penalties.

- In the event of omission or delay, interest is charged on the amount due, along with flat-rate fines of up to several hundred euros, depending on the seriousness of the negligence, the amount not declared, and the length of the delay. It is always possible to rectify the situation, but the later the rectification, the higher the penalties.

- Tax non-compliance can be an obstacle to the sale of a property.

Practical tips for optimizing your tax situation

- Delegate the declaration to a local tax administrator.

- Consolidate rental income to reduce errors.

- Compare Spain's tax system with that of your country of residence (tax treaties).

Resources and useful links

Download here modelo 210 if you have a cl@ve access or an electronic certificate.

To find out more about property taxation in Spain, see also :

Capital gains tax on real estate

Are you planning to invest in Spain?

Benefit from comprehensive support to find the ideal property, ensure efficient rental management and remain compliant with local tax regulations.

Contact a Terreta real estate advisor today to find out more.

Sources : Agencia Tributaria

FAQ - Rental taxation in Spain for foreign investors (2025)

Who is considered a tax resident in Spain?

An investor is tax resident in Spain if he or she spends more than 183 days a year there, or if the center of his or her economic interests is located there. Residents are taxed on all their worldwide income, while non-residents are only taxed on income generated in Spain.

Do non-residents have to file a tax return in Spain?

Yes, all non-resident investors earning rental income in Spain must file a tax return using the Modelo 210 form. Even if the property is unoccupied, a notional income(renta imputada) must be declared each year.

What is the tax rate for a foreign investor in Spain in 2025?

For residents of the European Union or the European Economic Area, the tax rate is 19% on net income, after deduction of expenses. For non-EU/EEA residents, the rate is 24% on gross income, with no deductions. This regime applies to all rental taxes in Spain.

What is the tax difference between a tourist rental and a long-term rental?

Tax rates are identical. What changes are the administrative formalities (e.g. tourist license, depending on the region), local obligations (such as tourist tax) and stricter controls on short-term rentals, notably via the mandatory national register since July 2025.

How often should I declare my rental income?

If the property is rented out (long-term or seasonal rental), the declaration is now annual via the Modelo 210 (previously quarterly). If the property is not rented, the declaration is annual for renta imputada (theoretical income). This is compulsory for all non-resident tax declarations in Spain.

What expenses are deductible for European investors?

Investors resident in the EU or EEA can deduct certain expenses: interest on loans, management fees, insurance, maintenance, repairs, condominium fees and local taxes such as IBI. These deductions are not allowed for non-EU residents, unless there are specific exceptions.

What exactly is IBI?

IBI (Impuesto sobre Bienes Inmuebles) is a local property tax payable each year by all owners, whether resident or non-resident. It is calculated on the cadastral value of the property and varies by municipality (generally between 0.4% and 1.1%). This tax is independent of rental income tax, and must be paid even if the property is unoccupied.

What are the risks of not declaring rental income in Spain?

The penalties for failing to declare a property are considerable: lump-sum fines, interest for late payment, and the risk of the property being blocked when it is resold. It is always possible to regularize the situation, but the longer the delay, the higher the penalties.

How to fill the Modelo 210?

The Modelo 210 form can be filled in and sent online via the official Agencia Tributaria website. It can also be downloaded, filled in manually and sent by post. Payment can be made by bank transfer, direct debit or credit card.