First step: the NIE

A crucial step before embarking on the purchase of a property, obtaining the NIE is your first step to becoming a property owner in Spain. In parallel, you can start step 2, the search for financing which can be done simultaneously, and also requires an average of 2 months.

What is the NIE?

This is the Foreigner Identification Number. It is a personal, unique number that the Spanish administration assigns to each foreigner.

This number is essential for many administrative procedures, including opening a bank account, a telephone line, renting or buying a home, and a thousand other things.

What is the cost of obtaining the NIE?

From a few euros to a few hundred euros, depending on the option you choose.

What are the processing times?

The average processing time is often 2 to 3 months. This is why it is necessary to start this process as quickly as possible.

Complete guide

To learn more, consult our complete guide on the NIE, which details how and where to obtain it, as well as the documents and forms necessary for obtaining it.

Second step: the mortgage

Should you make a purchase offer before starting your financing search?

No, that's the worst mistake you could make.

Take care of your financing first, in parallel with your NIE application.

Only then, move forward with your real estate purchase in Spain.

Why?

Because you risk underestimating the personal contribution required to buy in Spain. You would take the risk of making a purchase offer for a property that you will not be able to buy due to lack of equity. Indeed, a Spanish bank will only lend you 70% of the price of the property on average, and your personal contribution must therefore be 30% of the price of the property to which all additional costs must be added. On the total cost of the project, it is often estimated that 50% will be financed by a Spanish bank, and 50% by your own funds.

Beware of this mistake, it can cost you dearly.

Not validating your financing and your budget before making a purchase offer is a mistake that can cost you dearly. Indeed, in Spain, sellers very often refuse clauses of non-obtainment of credit, and you could lose up to 10% of the price of the property if you fail to finance the purchase. This corresponds to the 10% of the price of the property that you will have paid as a deposit ("Arras" in Spanish) that the seller will legally have the right to keep if you have to give up, after signing the preliminary sales agreement.

To learn more, consult our comprehensive guide which will explain how to obtain a mortgage for your property purchase in Spain.

Key takeaways:

- Financing through a Spanish bank

- Can finance up to 70% of the property price

- Generally does not include renovations or furniture.

- Required equity: 30% of the property price, notary fees, real estate agent fees, renovations.

- Financing through a bank in your country of tax residence:

- Can finance up to 100% of the total cost of the transaction

- Is only accessible if you can mortgage a debt-free property in your country of tax residence, or provide other assets that the bank can secure: life insurance, stocks, assets.

Conclusion : plan for equity of 50% of the property price, or 50% of the total project cost, to avoid unpleasant surprises.

Third step: define your project very precisely

Personal contribution, purchase objective, and incompatibility triangle

To avoid wasting your time, it is essential to determine your criteria very precisely.

Here are the three questions you need to answer before starting your search.

- What is your personal contribution?

- What is the objective of the purchase?

- The important criteria in your eyes

1. The personal contribution determines the price of the property you can buy

If your personal contribution is €100,000, you can buy an apartment with a sale price of:

- €200,000 if you do not carry out any renovations and do not furnish the apartment

- €150,000 if you carry out €25,000 of renovations and furnishing.

Conclusion : as the Spanish bank only finances 70% of the property price, your personal contribution will determine your budget. Do not start looking at real estate listings without having precisely determined your budget.

2. The objective of the purchase

Rental investment, or a wealth-building purchase of a second home?

Are you counting on passive income, on a positive cash flow to supplement your income?

How much do you need to earn each month from your rental income to retire early?

Many of our clients have purchased multiple apartments with our assistance to retire before the official retirement age. By understanding your objectives, we can tailor our efforts to support your ambitions.

3. Criteria that are important to you

Here are some questions to ask yourself to precisely define your project:

- Rental profitability is often inversely proportional to the attractiveness of the neighborhood.

- Rental profitability is often inversely proportional to the increase in land value (rise in property prices upon sale).

- Is it important for you to buy near universities? Beaches? Public transportation?

Fourth step: Buying well

Precisely determine the criteria that are important to you.

New or renovated property?

Buying a property to renovate has many advantages:

- Greater negotiation margin

- Significant added value after renovations

- Making your property more attractive

- Finding quality tenants

- Adapting the property to your expectations

The incompatibility triangle

You have to sacrifice one of the three criteria among the following:

- Rental yield

- Location

- Aesthetics

A profitable, well-located, and beautiful property would be ideal. In reality, you have to know how to buy a reasonably attractive profitable property in an up-and-coming neighborhood. Or a beautiful property in the heart of the city center, but necessarily less profitable.

Know thyself, as Socrates said. What are your two predominant criteria?

The search for the perfect property

Buying an apartment in Spain means knowing how to search for yourself and being supported to take action.

The most classic path is to follow these two steps:

- Internet searches: idealista.com and all other real estate sites. After a few months wasted looking at listings without making progress,

- Support from a real estate professional : benefit from expert guidance to save time, receive valuable advice, verify compliance, and avoid unpleasant surprises.

Buyers often want to avoid using a property finder to avoid paying fees. After several months wasted looking at listings on idealista without making progress, it is better to move on to step 2 and seek support.

Each month that passes without a purchase is a month without rental income. Consider that after 6 months of wandering around the internet, you will have already lost several thousand euros in unreceived rental income. Not to mention that a good property finder helps you aggressively negotiate sale prices, sometimes more than offsetting the cost of their fees for the buying client.

Fifth step: the purchase offer

Three steps for which we support our clients step by step.

- Formulating a purchase offer

- Signing the preliminary sales agreement ("Contrato de arras" in Spanish)

- Signing the final deed ("escritura" in Spanish)

Let's detail these three steps:

1. Formulating an offer

- Writing the purchase offer

- Bank transfer of the “señal”, generally around €1,000 to €5,000, to signal the seriousness of the purchase offer.

- If the offer is accepted, the amount will be deducted from the sale price.

- If the offer is rejected, the amount will be immediately refunded.

2. Signing the preliminary sales agreement – "contrato de arras"

- Contract between seller and buyer defining the clauses of the agreement

- Supplement to the financial advance to reach 10% of the property value.

- "Arras penitenciales":

- If the buyer withdraws, they will lose the amounts advanced.

- If the seller withdraws, they must reimburse the buyer twice the amounts advanced.

3. Signing the final deed – "escritura"

- Payment of the balance

- Handing over the keys

Sixth step: your checklist once the sale has been completed at the notary

Once you are an owner, it is not over. There are still a few steps to take:

- Transfer the energy contracts to your name: electricity, water, gas, etc.

- Inform the co-ownership association of the change of owner

- Pay the taxes related to the transaction

- Register the purchase in the property registry

- Start the renovation of the property, then the decoration or furnishing

- Offer your property for rent if you wish to generate rental income

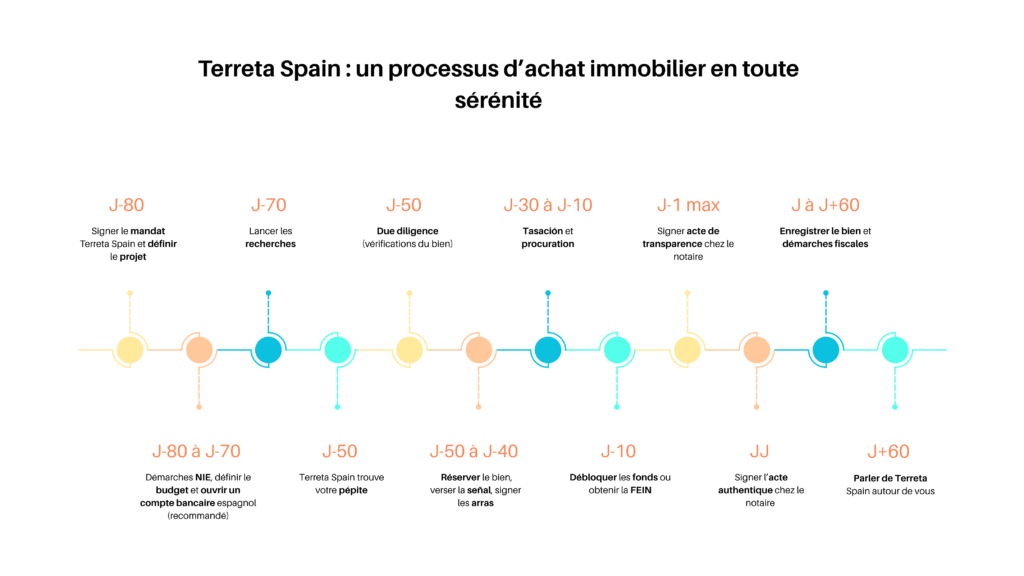

Summary - your Spanish project timeline

If you'd like to visualize the different stages of your purchase in Spain in a clear, step-by-step timeline, take a look at our article on the subject.